Page 99 - IC26 LIFE INSURANCE FINANCE

P. 99

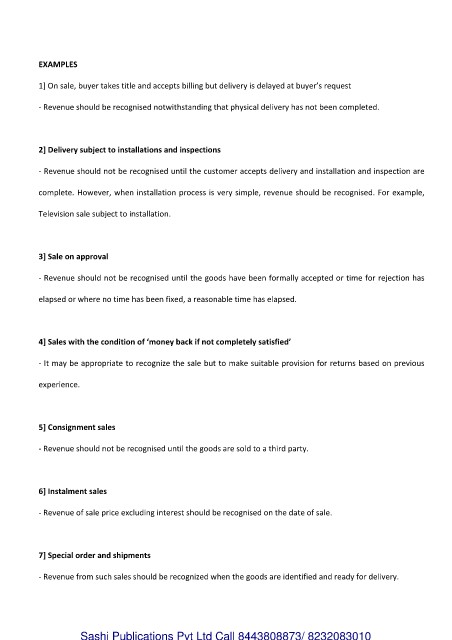

EXAMPLES

1] On sale, buyer takes title and accepts billing but delivery is delayed at buyer’s request

- Revenue should be recognised notwithstanding that physical delivery has not been completed.

2] Delivery subject to installations and inspections

- Revenue should not be recognised until the customer accepts delivery and installation and inspection are

complete. However, when installation process is very simple, revenue should be recognised. For example,

Television sale subject to installation.

3] Sale on approval

- Revenue should not be recognised until the goods have been formally accepted or time for rejection has

elapsed or where no time has been fixed, a reasonable time has elapsed.

4] Sales with the condition of ‘money back if not completely satisfied’

- It may be appropriate to recognize the sale but to make suitable provision for returns based on previous

experience.

5] Consignment sales

- Revenue should not be recognised until the goods are sold to a third party.

6] Instalment sales

- Revenue of sale price excluding interest should be recognised on the date of sale.

7] Special order and shipments

- Revenue from such sales should be recognized when the goods are identified and ready for delivery.

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010