Page 20 - Insurance Times May 2022

P. 20

General Insurers by citing those offered by the National Insurance Company Section A: Medical Expenses,

Limited, (NICL). There are three main categories of policies . Specific policies are Evacuation, Repatriation-USD 15,000.

available for persons travelling abroad on Business and/Holiday, Employment and Section B: Personal Accident,

Studies Travel and for Corporate Frequent Travellers. The policies do not cover Permanent Disability- USD 7,500.

persons going abroad for treatment or travelling against medical advice. Pre-

existing diseases are not covered. Medical and diagnostic test reports are required The Overseas Mediclaim Insurance Policy

for persons over 70 years of age and for over 60 days of travel. An international for Employment and Studies covers

service provider is available for claims assistance. Medical Accident and Illness Expenses

Coverage for medical expenses upto the

The Business and/or Holiday Policy has six sections; namely Medical Expenses and Sum Insured, as approved by a registered

Repatriation, Personal Accident, Loss of Checked in Baggage, Delay in Checked in medical practitioner and the Claims

Baggage, Loss of Passport and Personal Liability. There are four Plans with separate Administrator. Medical Evacuation

Sum Insureds varying from 50,000 USD to 5,00,000 USD in four slabs. In case, no Expenses when as a result of a Injury or

Medical Reports are submitted due to paucity of time; in case of persons above 70 illness, an Insured Person is hospitalized

years of age, a restricted Medical Expenses Cover for 10,000 USD is allowed. the Insurers will pay upon the

There are also Section wise sub-limits and deductibles. Standard exclusions apply recommendation and prior approval of

to the policies. The Policy is issued for a maximum period of 180 days, at a time. the attending physician and the Claims

Administrator of this Insurance for the

The Plan-wise and Section-wise Sum Insured under the aforesaid Policy has been evacuation of the Insured Person to India.

taken from the website of (NICL) and is as follows:

In case of death of the Insured person

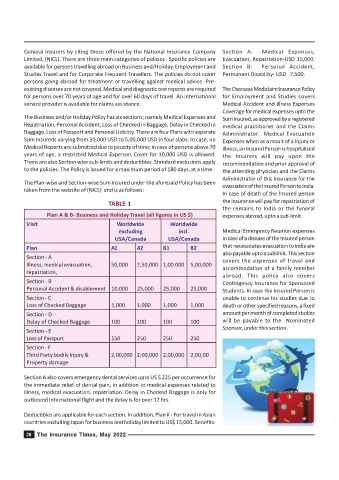

TABLE 1 the insurance will pay for repatriation of

the remains to India or the funeral

Plan A & B- Business and Holiday Travel (all figures in US $) expenses abroad, upto a sub-limit.

Visit Worldwide Worldwide

excluding incl. Medical Emergency Reunion expenses

USA/Canada USA/Canada in case of a disease of the Insured person

Plan A1 A2 B1 B2 that necessitates evacuation to India are

also payable upto a sublimit. This section

Section - A

covers the expenses of travel and

Illness, medical evacuation, 50,000 2,50,000 1,00.000 5,00,000 accommodation of a family member

repatriation,

abroad. This policy also covers

Section - B Contingency Insurance for Sponsored

Personal Accident & disablement 10,000 25,000 25,000 25,000 Students. In case the Insured Person is

Section - C unable to continue his studies due to

Loss of Checked Baggage 1,000 1,000 1,000 1,000 death or other specified reasons, a fixed

Section - D amount per month of completed studies

Delay of Checked Baggage 100 100 100 100 will be payable to the Nominated

Sponsor, under this section.

Section - E

Loss of Passport 150 250 250 250

Section - F

Third Party bodily Injury & 2,00,000 2,00,000 2,00,000 2,00,00

Property damage

Section A also covers emergency dental services upto US $ 225 per occurrence for

the immediate relief of dental pain, in addition to medical expenses related to

illness, medical evacuation, repatriation. Delay in Checked Baggage is only for

outbound International flight and the delay is for over 12 hrs.

Deductibles are applicable for each section. In addition, Plan K - For travel in Asian

countries excluding Japan for business and holiday limited to US$ 15,000. Benefits:

20 The Insurance Times, May 2022