Page 26 - Banking Finance July 2022

P. 26

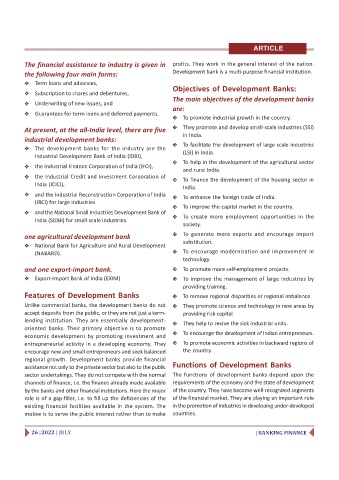

ARTICLE

The financial assistance to industry is given in profits. They work in the general interest of the nation.

Development bank is a multi-purpose financial institution.

the following four main forms:

Term loans and advances,

Objectives of Development Banks:

Subscription to shares and debentures,

The main objectives of the development banks

Underwriting of new issues, and

are:

Guarantees for term loans and deferred payments.

To promote industrial growth in the country.

They promote and develop small-scale industries (SSI)

At present, at the all-India level, there are five

in India.

industrial development banks:

To facilitate the development of large-scale industries

The development banks for the industry are the

(LSI) in India.

Industrial Development Bank of India (IDBI),

To help in the development of the agricultural sector

the Industrial Finance Corporation of India (IFCI),

and rural India.

the Industrial Credit and Investment Corporation of

To finance the development of the housing sector in

India (ICICI),

India.

and the Industrial Reconstruction Corporation of India

To enhance the foreign trade of India.

(IRCI) for large industries

To improve the capital market in the country.

and the National Small Industries Development Bank of

To create more employment opportunities in the

India (SIDBI) for small-scale industries.

society.

To generate more exports and encourage import

one agricultural development bank

substitution.

National Bank for Agriculture and Rural Development

To encourage modernization and improvement in

(NABARD).

technology.

and one export-import bank. To promote more self-employment projects.

Export-Import Bank of India (EXIM) To improve the management of large industries by

providing training.

Features of Development Banks To remove regional disparities or regional imbalance.

Unlike commercial banks, the development banks do not They promote science and technology in new areas by

accept deposits from the public, or they are not just a term- providing risk capital

lending institution. They are essentially development-

They help to revive the sick industrial units.

oriented banks. Their primary objective is to promote

To encourage the development of Indian entrepreneurs.

economic development by promoting investment and

entrepreneurial activity in a developing economy. They To promote economic activities in backward regions of

encourage new and small entrepreneurs and seek balanced the country.

regional growth. Development banks provide financial

Functions of Development Banks

assistance not only to the private sector but also to the public

sector undertakings. They do not compete with the normal The functions of development banks depend upon the

channels of finance, i.e. the finance already made available requirements of the economy and the state of development

by the banks and other financial institutions. Here the major of the country. They have become well-recognized segments

role is of a gap-filler, i.e. to fill up the deficiencies of the of the financial market. They are playing an important role

existing financial facilities available in the system. The in the promotion of industries in developing under-developed

motive is to serve the public interest rather than to make countries.

26 | 2022 | JULY | BANKING FINANCE