Page 32 - Banking Finance July 2022

P. 32

ARTICLE

Adopting plan evaluation process akin to Swiss Challenge, it retains competitive tension such that promoters propose

plans with least impairment to rights and claims of creditors. The ability of the committee of creditors to require dilution

of promoter shareholding/ control, in cases resolution plans submitted by the corporate debtor provides for impairment

of any claims owed by such corporate debtor, should also be a significant deterrent against unreasonable terms in resolution

plans. The Pre-pack resolution must be approved by financial creditors with a minimum 66 percent voting share by value.

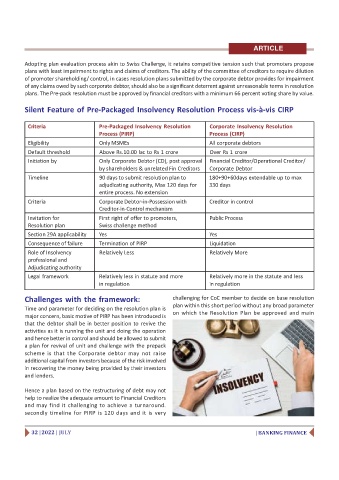

Silent Feature of Pre-Packaged Insolvency Resolution Process vis-à-vis CIRP

Criteria Pre-Packaged Insolvency Resolution Corporate Insolvency Resolution

Process (PIRP) Process (CIRP)

Eligibility Only MSMEs All corporate debtors

Default threshold Above Rs.10.00 lac to Rs 1 crore Over Rs 1 crore

Initiation by Only Corporate Debtor (CD), post approval Financial Creditor/Operational Creditor/

by shareholders & unrelated Fin Creditors Corporate Debtor

Timeline 90 days to submit resolution plan to 180+90+60days extendable up to max

adjudicating authority, Max 120 days for 330 days

entire process. No extension

Criteria Corporate Debtor-in-Possession with Creditor in control

Creditor-in-Control mechanism

Invitation for First right of offer to promoters, Public Process

Resolution plan Swiss challenge method

Section 29A applicability Yes Yes

Consequence of failure Termination of PIRP Liquidation

Role of Insolvency Relatively Less Relatively More

professional and

Adjudicating authority

Legal framework Relatively less in statute and more Relatively more in the statute and less

in regulation in regulation

Challenges with the framework: challenging for CoC member to decide on base resolution

plan within this short period without any broad parameter

Time and parameter for deciding on the resolution plan is

on which the Resolution Plan be approved and main

major concern, basic motive of PIRP has been introduced is

that the debtor shall be in better position to revive the

activities as it is running the unit and doing the operation

and hence better in control and should be allowed to submit

a plan for revival of unit and challenge with the prepack

scheme is that the Corporate debtor may not raise

additional capital from investors because of the risk involved

in recovering the money being provided by their investors

and lenders.

Hence a plan based on the restructuring of debt may not

help to realize the adequate amount to Financial Creditors

and may find it challenging to achieve a turnaround.

secondly timeline for PIRP is 120 days and it is very

32 | 2022 | JULY | BANKING FINANCE