Page 22 - Insurance Times July 2021

P. 22

o Individual financial influences that may lead to

fraud:

1. Financial difficulties (33%)

a. High personal debts or financial losses

b. Inadequate income

2. Living beyond one's means (44%)

o Individual conducts that may lead to fraud:

1. Broad stock market or other types of

speculation (starting a new business)

2. Extensive gambling

3. Illicit affairs

4. Excessive use of alcohol or drugs (12%)

B) Opportunity factors:

1. Magnitude of fraud would decrease if the

opportunity did not exist:

a. Reasons for increased fraud risk:

i. Crime requires a simple act

ii. Chances of being detected are very slim

iii. Punishment is very light

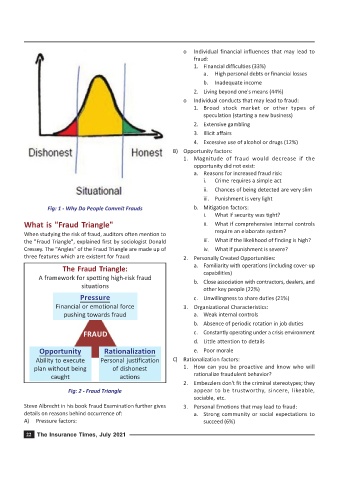

Fig: 1 - Why Do People Commit Frauds b. Mitigation factors:

i. What if security was tight?

What is "Fraud Triangle" ii. What if comprehensive internal controls

require an elaborate system?

When studying the risk of fraud, auditors often mention to

the "Fraud Triangle", explained first by sociologist Donald iii. What if the likelihood of finding is high?

Cressey. The "Angles" of the Fraud Triangle are made up of iv. What if punishment is severe?

three features which are existent for fraud: 2. Personally Created Opportunities:

The Fraud Triangle: a. Familiarity with operations (including cover-up

capabilities)

A framework for spotting high-risk fraud

situations b. Close association with contractors, dealers, and

other key people (22%)

Pressure c. Unwillingness to share duties (21%)

Financial or emotional force 3. Organizational Characteristics:

pushing towards fraud a. Weak internal controls

b. Absence of periodic rotation in job duties

FRAUD c. Constantly operating under a crisis environment

d. Little attention to details

Opportunity Rationalization e. Poor morale

Ability to execute Personal justification C) Rationalization factors:

plan without being of dishonest 1. How can you be proactive and know who will

caught actions rationalize fraudulent behavior?

2. Embezzlers don't fit the criminal stereotypes; they

Fig: 2 - Fraud Triangle appear to be trustworthy, sincere, likeable,

sociable, etc.

Steve Albrecht in his book Fraud Examination further gives 3. Personal Emotions that may lead to fraud:

details on reasons behind occurrence of: a. Strong community or social expectations to

A) Pressure factors: succeed (6%)

22 The Insurance Times, July 2021