Page 49 - Banking Finance April 2019

P. 49

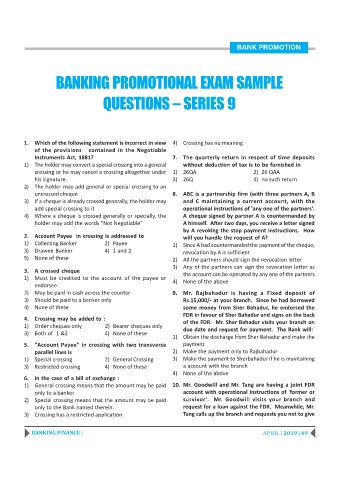

BANK PROMOTION

BANKING PROMOTIONAL EXAM SAMPLE

QUESTIONS – SERIES 9

1. Which of the following statement is incorrect in view 4) Crossing has no meaning

of the provisions contained in the Negotiable

Instruments Act, 1881? 7. The quarterly return in respect of time deposits

1) The holder may convert a special crossing into a general without deduction of tax is to be furnished in

crossing or he may cancel a crossing altogether under 1) 26QA 2) 26 QAA

his signature. 3) 26Q 4) no such return

2) The holder may add general or special crossing to an

uncrossed cheque 8. ABC is a partnership firm (with three partners A, B

3) If a cheque is already crossed generally, the holder may and C maintaining a current account, with the

add special crossing to it operational instructions of 'any one of the partners'.

4) Where a cheque is crossed generally or specially, the A cheque signed by partner A is countermanded by

holder may add the words "Not Negotiable" A himself. After two days, you receive a letter signed

by A revoking the stop payment instructions. How

2. Account Payee in crossing is addressed to will you handle the request of A?

1) Collecting Banker 2) Payee 1) Since A had countermanded the payment of the cheque,

3) Drawee Banker 4) 1 and 2 revocation by A is sufficient

5) None of these 2) All the partners should sign the revocation letter

3) Any of the partners can sign the revocation letter as

3. A crossed cheque the account can be operated by any one of the partners

1) Must be credited to the account of the payee or 4) None of the above

endorsee

2) May be paid in cash across the counter 9. Mr. Rajbahadur is having a Fixed deposit of

3) Should be paid to a banker only Rs.15,000/- at your branch. Since he had borrowed

4) None of these some money from Sher Bahadur, he endorsed the

FDR in favour of Sher Bahadur and signs on the back

4. Crossing may be added to : of the FDR. Mr. Sher Bahadur visits your branch on

1) Order cheques only 2) Bearer cheques only due date and request for payment. The Bank will:

3) Both of 1 &2 4) None of these

1) Obtain the discharge from Sher Bahadur and make the

5. "Account Payee" in crossing with two transverse payment

parallel lines is 2) Make the payment only to Rajbahadur

1) Special crossing 2) General Crossing 3) Make the payment to Sherbahadur if he is maintaining

3) Restricted crossing 4) None of these a account with the branch

4) None of the above

6. In the case of a bill of exchange :

1) General crossing means that the amount may be paid 10. Mr. Goodwill and Mr. Tang are having a joint FDR

only to a banker account with operational instructions of 'former or

2) Special crossing means that the amount may be paid survivor'. Mr. Goodwill visits your branch and

only to the Bank named therein. request for a loan against the FDR. Meanwhile, Mr.

3) Crossing has a restricted application Tang calls up the branch and requests you not to give

BANKING FINANCE | APRIL | 2019 | 49