Page 44 - Banking Finance April 2019

P. 44

ARTICLE

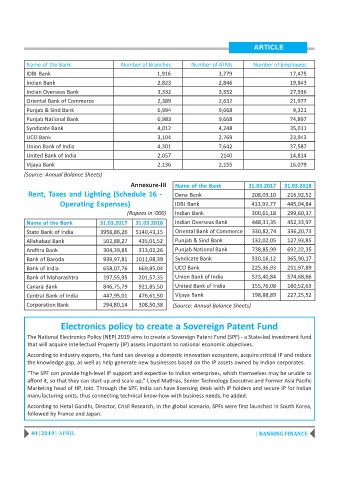

Name of the Bank Number of Branches Number of ATMs Number of Employees

IDBI Bank 1,916 3,779 17,475

Indian Bank 2,823 2,846 19,843

Indian Overseas Bank 3,332 3,552 27,936

Oriental Bank of Commerce 2,389 2,632 21,977

Punjab & Sind Bank 6,994 9,668 9,321

Punjab National Bank 6,983 9,668 74,897

Syndicate Bank 4,012 4,248 35,011

UCO Bank 3,104 2,769 23,943

Union Bank of India 4,301 7,642 37,587

United Bank of India 2,057 2140 14,814

Vijaya Bank 2,136 2,155 16,079

(Source: Annual Balance Sheets)

Annexure-III Name of the Bank 31.03.2017 31.03.2018

Rent, Taxes and Lighting (Schedule 16 - Dena Bank 208,03,10 216,92,52

Operating Expenses) IDBI Bank 433,92,77 445,04,84

(Rupees in '000) Indian Bank 300,61,18 299,60,37

Name of the Bank 31.03.2017 31.03.2018 Indian Overseas Bank 448,31,35 452,33,97

State Bank of India 3956,86,26 5140,43,15 Oriental Bank of Commerce 330,82,74 336,20,73

Allahabad Bank 502,88,27 435,01,52 Punjab & Sind Bank 132,02,05 127,93,85

Andhra Bank 304,39,85 313,02,26 Punjab National Bank 738,85,99 692,22,35

Bank of Baroda 939,97,81 1011,08,39 Syndicate Bank 330,16,12 365,90,17

Bank of India 658,07,76 669,85,04 UCO Bank 225,36,93 251,97,89

Bank of Maharashtra 197,55,95 201,57,35 Union Bank of India 523,40,84 574,68,66

Canara Bank 846,75,79 921,85,50 United Bank of India 155,76,08 160,52,63

Central Bank of India 447,95,01 476,61,50 Vijaya Bank 198,88,89 227,25,52

Corporation Bank 294,80,14 308,50,38 (Source: Annual Balance Sheets)

Electronics policy to create a Sovereign Patent Fund

The National Electronics Policy (NEP) 2019 aims to create a Sovereign Patent Fund (SPF) - a State-led investment fund

that will acquire Intellectual Property (IP) assets important to national economic objectives.

According to industry experts, the fund can develop a domestic innovation ecosystem, acquire critical IP and reduce

the knowledge gap, as well as help generate new businesses based on the IP assets owned by Indian corporates.

"The SPF can provide high-level IP support and expertise to Indian enterprises, which themselves may be unable to

afford it, so that they can start up and scale up," Lloyd Mathias, Senior Technology Executive and Former Asia Pacific

Marketing head of HP, told. Through the SPF, India can have licensing deals with IP holders and secure IP for Indian

manufacturing units, thus connecting technical know-how with business needs, he added.

According to Hetal Gandhi, Director, Crisil Research, in the global scenario, SPFs were first launched in South Korea,

followed by France and Japan.

44 | 2019 | APRIL | BANKING FINANCE