Page 31 - DTPA Journal Aug 18

P. 31

DTPA - J | 2017-18 | Volume 3 | August 2018

A glimpse of the Recent Amendments in GST

CA Subham Khaitan

The following amendments have been notified by the taxpayers has been enabled through a special

Government in GSTrecently: procedure as per Notification no. 31/2018-

th

ØFor persons who had only received the Central Tax dated 6 August 2018.

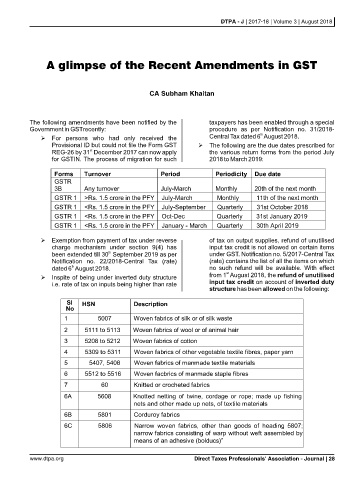

Provisional ID but could not file the Form GST ØThe following are the due dates prescribed for

st

REG-26 by 31 December 2017 can now apply the various return forms from the period July

for GSTIN. The process of migration for such 2018 to March 2019:

ØExemption from payment of tax under reverse of tax on output supplies, refund of unutilised

charge mechanism under section 9(4) has input tax credit is not allowed on certain items

th

been extended till 30 September 2019 as per under GST. Notification no. 5/2017-Central Tax

Notification no. 22/2018-Central Tax (rate) (rate) contains the list of all the items on which

th

dated 6 August 2018. no such refund will be available. With effect

st

ØInspite of being under inverted duty structure from 1 August 2018, the refund of unutilised

i.e. rate of tax on inputs being higher than rate input tax credit on account of inverted duty

structure has been allowed on the following:

www.dtpa.org Direct Taxes Professionals' Association - Journal | 28