Page 32 - DTPA Journal Aug 18

P. 32

DTPA - J | 2017-18 | Volume 3 | August 2018

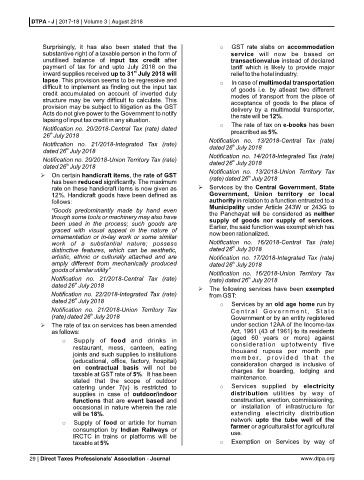

Surprisingly, it has also been stated that the o GST rate slabs on accommodation

substantive right of a taxable person in the form of service will now be based on

unutilised balance of input tax credit after transactionvalue instead of declared

payment of tax for and upto July 2018 on the tariff which is likely to provide major

st

inward supplies received up to 31 July 2018 will relief to the hotel industry.

lapse. This provision seems to be regressive and o In case of multimodal transportation

difficult to implement as finding out the input tax of goods i.e. by atleast two different

credit accumulated on account of inverted duty modes of transport from the place of

structure may be very difficult to calculate. This acceptance of goods to the place of

provision may be subject to litigation as the GST delivery by a multimodal transporter,

Acts do not give power to the Government to notify the rate will be 12%.

lapsing of input tax credit in any situation.

o The rate of tax on e-books has been

Notification no. 20/2018-Central Tax (rate) dated prescribed as 5%.

th

26 July 2018

Notification no. 13/2018-Central Tax (rate)

Notification no. 21/2018-Integrated Tax (rate) th

th

dated 26 July 2018 dated 26 July 2018

Notification no. 14/2018-Integrated Tax (rate)

Notification no. 20/2018-Union Territory Tax (rate) dated 26 July 2018

th

th

dated 26 July 2018

Notification no. 13/2018-Union Territory Tax

Ø th

On certain handicraft items, the rate of GST

has been reduced significantly. The maximum (rate) dated 26 July 2018

Services by the Central Government, State

rate on these handicraft items is now given as Ø

12%. Handicraft goods have been defined as Government, Union territory or local

follows: authority in relation to a function entrusted to a

Municipality under Article 243W or 243G to

“Goods predominantly made by hand even the Panchayat will be considered as neither

though some tools or machinery may also have

been used in the process; such goods are supply of goods nor supply of services.

graced with visual appeal in the nature of Earlier, the said function was exempt which has

now been rationalized.

ornamentation or in-lay work or some similar

work of a substantial nature; possess Notification no. 16/2018-Central Tax (rate)

th

distinctive features, which can be aesthetic, dated 26 July 2018

artistic, ethnic or culturally attached and are Notification no. 17/2018-Integrated Tax (rate)

th

amply different from mechanically produced dated 26 July 2018

goods of similar utility”

Notification no. 16/2018-Union Territory Tax

Notification no. 21/2018-Central Tax (rate) (rate) dated 26 July 2018

th

th

dated 26 July 2018

Ø

The following services have been exempted

Notification no. 22/2018-Integrated Tax (rate) from GST:

th

dated 26 July 2018

o Services by an old age home run by

Notification no. 21/2018-Union Territory Tax C e n t r a l G o v e r n m e n t , S t a t e

th

(rate) dated 26 July 2018 Government or by an entity registered

The rate of tax on services has been amended

Ø under section 12AA of the Income-tax

as follows: Act, 1961 (43 of 1961) to its residents

(aged 60 years or more) against

o Supply of food and drinks in

consideration uptotwenty five

restaurant, mess, canteen, eating thousand rupees per month per

joints and such supplies to institutions

(educational, office, factory, hospital) m e m b e r, p r o v i d e d t h a t t h e

consideration charged is inclusive of

on contractual basis will not be charges for boarding, lodging and

taxable at GST rate of 5%. It has been maintenance.

stated that the scope of outdoor

catering under 7(v) is restricted to o Services supplied by electricity

supplies in case of outdoor/indoor distribution utilities by way of

functions that are event based and construction, erection, commissioning,

occasional in nature wherein the rate or installation of infrastructure for

will be 18%. extending electricity distribution

network upto the tube well of the

o Supply of food or article for human farmer or agriculturalist for agricultural

consumption by Indian Railways or use.

IRCTC in trains or platforms will be

taxable at 5% o Exemption on Services by way of

29 | Direct Taxes Professionals' Association - Journal www.dtpa.org