Page 36 - Insurance Times Janaury 2021

P. 36

well as the centre of a thriving and comprehensive few years, we have seen rapid growth followed by what we

ecosystem of cyber security service providers. "No other city all hope to be a temporary plateau. Insurers are issuing

has London's concentration of (re)insurers and brokers, co- more policies. The amounts of protection are increasing. In

located with some of the world's leading cyber security fact, our community has finally seen the first cyber

service providers spanning across InsurTech start-ups, large insurance programme to exceed $1 billion. Meanwhile, the

cyber technology vendors and specialist cyber law practice. breadth of coverage continues to expand. Cyber insurance

London is said to be well-placed to meet the growing is maturing and businesses are adapting to the new and

demand for cyber insurance and remain the pre-eminent emerging cyber security threat. Losses from incidents such

global hub. as distributed denial of service (DDoS) attacks or phishing

and ransomware campaigns account for a significant

The city is expected to serve globally as a hub for writing majority of the value of cyber claims today, unfortunately,

cyber insurance and offering associated protection services cyber attacks have become more frequent and severe.

as well as play a pivotal role in the cyber protection of UK

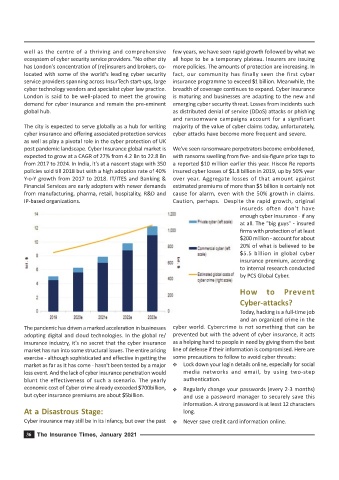

post pandemic landscape. Cyber Insurance global market is We've seen ransomware perpetrators become emboldened,

expected to grow at a CAGR of 27% from 4.2 Bn to 22.8 Bn with ransoms swelling from five- and six-figure price tags to

from 2017 to 2024. In India, it's at a nascent stage with 350 a reported $10 million earlier this year. Hiscox Re reports

policies sold till 2018 but with a high adoption rate of 40% insured cyber losses of $1.8 billion in 2019, up by 50% year

Y-o-Y growth from 2017 to 2018. IT/ITES and Banking & over year. Aggregate losses of that amount against

Financial Services are early adopters with newer demands estimated premiums of more than $5 billion is certainly not

from manufacturing, pharma, retail, hospitality, R&D and cause for alarm, even with the 50% growth in claims.

IP-based organizations. Caution, perhaps. Despite the rapid growth, original

insureds often don't have

enough cyber insurance - if any

at all. The "big guys" - insured

firms with protection of at least

$200 million - account for about

20% of what is believed to be

$5.5 billion in global cyber

insurance premium, according

to internal research conducted

by PCS Global Cyber.

How to Prevent

Cyber-attacks?

Today, hacking is a full-time job

and an organized crime in the

The pandemic has driven a marked acceleration in businesses cyber world. Cybercrime is not something that can be

adopting digital and cloud technologies. In the global re/ prevented but with the advent of cyber insurance, it acts

insurance industry, it's no secret that the cyber insurance as a helping hand to people in need by giving them the best

market has run into some structural issues. The entire pricing line of defense if their information is compromised. Here are

exercise - although sophisticated and effective in getting the some precautions to follow to avoid cyber threats:

market as far as it has come - hasn't been tested by a major Y Lock down your login details online, especially for social

loss event. And the lack of cyber insurance penetration would media networks and email, by using two-step

blunt the effectiveness of such a scenario. The yearly authentication.

economic cost of Cyber crime already exceeded $700billion, Y Regularly change your passwords (every 2-3 months)

but cyber insurance premiums are about $5billion. and use a password manager to securely save this

information. A strong password is at least 12 characters

At a Disastrous Stage: long.

Cyber insurance may still be in its infancy, but over the past Y Never save credit card information online.

36 The Insurance Times, January 2021