Page 24 - Banking Finance December 2022

P. 24

ARTICLE

and services. The percentage of MDR charges is agreed

upon before the merchant agrees to the setting up and

utilisation of the services and hereafter, the charges are

applicable on the transactions made.

MDR charge may also comprise of switching fee and

interchange fees.

a) Switching Fee - Switching fee is the fee that the card-

issuing institution like, Visa, MasterCard etc. levies and

can be referred to as the routing transaction between

the parties. RuPay cards, as per government mandate,

are free of MDR charges as an initiative to boost the

home-grown institution expanding digital payment.

Apart from RuPay cards, UPI also doesn't attract any

MDR.

b) Interchange Fee - Interchange fees include the amount

collected by the issuing institution from the acquiring

bank. Generally, it consists of a percentage of the total

transaction amount and a fixed amount. This fee is

charged by the customer's bank from the merchant's

Is MDR Charge necessary?

bank to process digital transactions.

To sustain and nourish the continuity of payment

infrastructure, payment processing fees are crucial which

The merchant tries to pass on the MDR charges to the

are responsible for encouraging global e-commerce. With

customers which is called TDR. TDR Stands for Transaction

payment gateways and aggregators being involved in online

Discount Rate. This fee is charged by the merchants to their

transactions, MDR charges serve as a profit opportunity for

customers for making a payment through payment gateway

them. Eliminating MDR could potentially kill the industry,

provided by them for collecting funds. A TDR contains

leaving no motivation to expand the payment universe.

processing charges, bank charges, and taxes.

How aggregator collects charges?

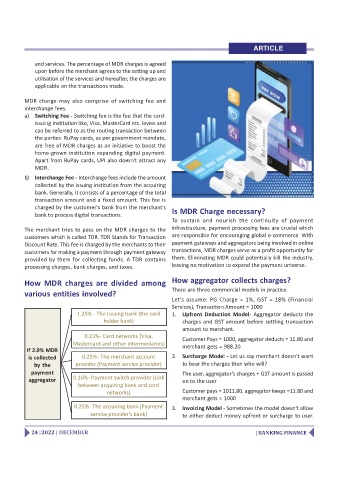

How MDR charges are divided among

There are three commercial models in practice.

various entities involved?

Let's assume: PG Charge = 1%, GST = 18% (Financial

Services), Transaction Amount = 1000

1.25% - The issuing bank (the card 1. Upfront Deduction Model- Aggregator deducts the

holder bank) charges and GST amount before settling transaction

amount to merchant.

0.15%- Card networks (Visa,

Customer Pays = 1000, aggregator deducts = 11.80 and

Mastercard and other intermediaries)

merchant gets = 988.20

If 2.0% MDR

is collected 0.25%- The merchant account 2. Surcharge Model - Let us say merchant doesn't want

by the provider (Payment service provider) to bear the charges then who will?

payment The user, aggregator's charges + GST amount is passed

0.10%- Payment switch provider (Link

aggregator on to the user

between acquiring bank and card

networks) Customer pays = 1011.80, aggregator keeps =11.80 and

merchant gets = 1000

0.25%- The acquiring bank (Payment

3. Invoicing Model - Sometimes the model doesn't allow

service provider's bank)

to either deduct money upfront or surcharge to user.

24 | 2022 | DECEMBER | BANKING FINANCE