Page 14 - Life Insurance Today December 2017

P. 14

Methodology

The present study is descriptive in nature. It includes the

individual life micro insurance policy of the selected

insurers. It is based on secondary data gathered from

annual reports of concerned units. The period of study

covers post Micro Insurance Act, 2005 i.e. ten years from

2006-07 to 2015-16. Descriptive statistical tools like

growth index, mean, standard deviation, CAGR, and t-test

have been applied for the purpose of analyses.

Data Analysis and Interpretation

Life insurance falls under the category of unsought It is clear from the Table 1 that LIC of India has performed

product. The product mix of life insurers contains life micro well as compared to ICICI Prudential in terms of compound

insurance products in the form of special plan. Micro annual growth rate, mean and growth index. The average

insurance is a plan offered to the lower and economically number of policies issued by LIC of India is 18.63 lakhs

backward masses due to their low purchasing power. That whereas in case of ICICI Prudential it is 3.79 lakhs which

means they are not able to afford high premium charged is five times lower to LIC of India. The standard deviation

in other plans. The Micro Insurance Act, 2005 advocates of LIC of India is high which reveals that there have been

the wide spread of micro insurance policies. As a matter fluctuations and data have been spread out over a wide

of fact, the micro insurance coverage is still at incipient range of values.

stage. Table 1 highlights the performance of LIC of India

and ICICI Prudential with respect to life micro insurance The growth index of LIC of India connotes that it has

plans under new business. increased to more than five times whereas the ICICI

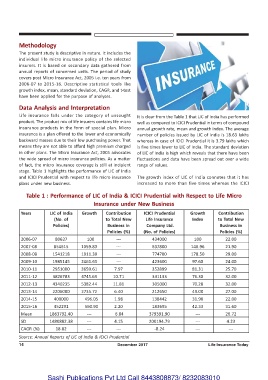

Table 1 : Performance of LIC of India & ICICI Prudential with Respect to Life Micro

Insurance under New Business

Years LIC of India Growth Contribution ICICI Prudential Growth Contribution

(No. of to Total New Life Insurance Index to Total New

Policies) Business in Company Ltd. Business in

Policies (%) (No. of Policies) Policies (%)

2006-07 80637 100 --- 434000 100 22.00

2007-08 854615 1059.83 --- 637800 146.96 21.90

2008-09 1541218 1911.30 --- 774700 178.50 29.00

2009-10 1985145 2461.65 --- 423600 97.60 24.00

2010-11 2951000 3659.61 7.97 352899 81.31 25.70

2011-12 3826783 4745.69 10.71 331133 76.30 32.00

2012-13 4340235 5382.44 11.81 305000 70.28 32.00

2013-14 2206000 2735.72 6.40 212650 49.00 27.00

2014-15 400000 496.05 1.98 138442 31.90 22.00

2015-16 452291 560.90 2.20 183695 42.33 31.60

Mean 1863792.40 --- 6.84 379391.90 --- 26.72

SD 1480882.38 --- 4.15 200194.79 --- 4.23

CAGR (%) 18.82 --- --- -8.24 --- ---

Source: Annual Reports of LIC of India & ICICI Prudential

14 December 2017 Life Insurance Today

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010