Page 26 - Banking Finance March 2021

P. 26

ARTICLE

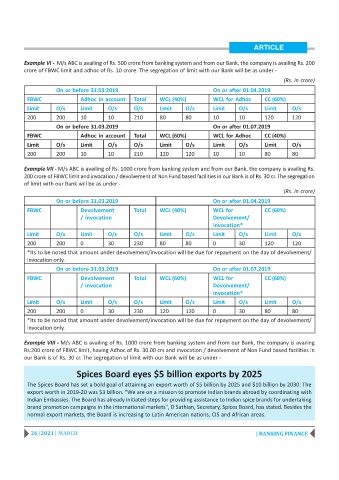

Example VI - M/s ABC is availing of Rs. 500 crore from banking system and from our Bank, the company is availing Rs. 200

crore of FBWC limit and adhoc of Rs. 10 crore. The segregation of limit with our Bank will be as under -

(Rs. in crore)

On or before 31.03.2019 On or after 01.04.2019

FBWC Adhoc in account Total WCL (40%) WCL for Adhoc CC (60%)

Limit O/s Limit O/s O/s Limit O/s Limit O/s Limit O/s

200 200 10 10 210 80 80 10 10 120 120

On or before 31.03.2019 On or after 01.07.2019

FBWC Adhoc in account Total WCL (60%) WCL for Adhoc CC (40%)

Limit O/s Limit O/s O/s Limit O/s Limit O/s Limit O/s

200 200 10 10 210 120 120 10 10 80 80

Example VII - M/s ABC is availing of Rs. 1000 crore from banking system and from our Bank, the company is availing Rs.

200 crore of FBWC limit and invocation / devolvement of Non Fund based facilities in our Bank is of Rs. 30 cr. The segregation

of limit with our Bank will be as under -

(Rs. in crore)

On or before 31.03.2019 On or after 01.04.2019

FBWC Devolvement Total WCL (40%) WCL for CC (60%)

/ invocation Devolvement/

invocation*

Limit O/s Limit O/s O/s Limit O/s Limit O/s Limit O/s

200 200 0 30 230 80 80 0 30 120 120

*Its to be noted that amount under devolvement/invocation will be due for repayment on the day of devolvement/

invocation only.

On or before 31.03.2019 On or after 01.07.2019

FBWC Devolvement Total WCL (60%) WCL for CC (60%)

/ invocation Devolvement/

invocation*

Limit O/s Limit O/s O/s Limit O/s Limit O/s Limit O/s

200 200 0 30 230 120 120 0 30 80 80

*Its to be noted that amount under devolvement/invocation will be due for repayment on the day of devolvement/

invocation only.

Example VIII - M/s ABC is availing of Rs. 1000 crore from banking system and from our Bank, the company is availing

Rs.200 crore of FBWC limit, having Adhoc of Rs. 30.00 crs and invocation / devolvement of Non Fund based facilities in

our Bank is of Rs. 30 cr. The segregation of limit with our Bank will be as under -

Spices Board eyes $5 billion exports by 2025

The Spices Board has set a bold goal of attaining an export worth of $5 billion by 2025 and $10 billion by 2030. The

export worth in 2019-20 was $3 billion. "We are on a mission to promote Indian brands abroad by coordinating with

Indian Embassies. The Board has already initiated steps for providing assistance to Indian spice brands for undertaking

brand promotion campaigns in the international markets", D Sathian, Secretary, Spices Board, has stated. Besides the

normal export markets, the Board is increasing to Latin American nations, CIS and African areas.

26 | 2021 | MARCH | BANKING FINANCE