Page 27 - Banking Finance March 2021

P. 27

ARTICLE

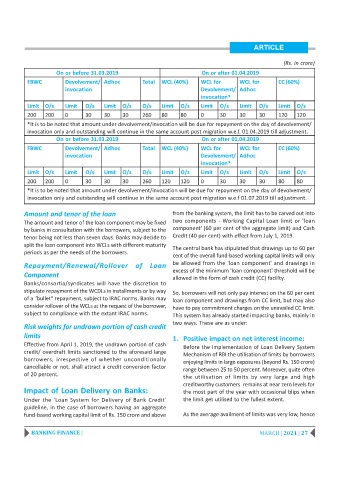

(Rs. in crore)

On or before 31.03.2019 On or after 01.04.2019

FBWC Devolvement/ Adhoc Total WCL (40%) WCL for WCL for CC (60%)

invocation Devolvement/ Adhoc

invocation*

Limit O/s Limit O/s Limit O/s O/s Limit O/s Limit O/s Limit O/s Limit O/s

200 200 0 30 30 30 260 80 80 0 30 30 30 120 120

*It is to be noted that amount under devolvement/invocation will be due for repayment on the day of devolvement/

invocation only and outstanding will continue in the same account post migration w.e.f. 01.04.2019 till adjustment.

On or before 31.03.2019 On or after 01.04.2019

FBWC Devolvement/ Adhoc Total WCL (40%) WCL for WCL for CC (60%)

invocation Devolvement/ Adhoc

invocation*

Limit O/s Limit O/s Limit O/s O/s Limit O/s Limit O/s Limit O/s Limit O/s

200 200 0 30 30 30 260 120 120 0 30 30 30 80 80

*It is to be noted that amount under devolvement/invocation will be due for repayment on the day of devolvement/

invocation only and outstanding will continue in the same account post migration w.e.f 01.07.2019 till adjustment.

Amount and tenor of the loan from the banking system, the limit has to be carved out into

The amount and tenor of the loan component may be fixed two components - Working Capital Loan limit or 'loan

by banks in consultation with the borrowers, subject to the component' (60 per cent of the aggregate limit) and Cash

tenor being not less than seven days. Banks may decide to Credit (40 per cent) with effect from July 1, 2019.

split the loan component into WCLs with different maturity The central bank has stipulated that drawings up to 60 per

periods as per the needs of the borrowers.

cent of the overall fund-based working capital limits will only

Repayment/Renewal/Rollover of Loan be allowed from the 'loan component' and drawings in

excess of the minimum 'loan component' threshold will be

Component

allowed in the form of cash credit (CC) facility.

Banks/consortia/syndicates will have the discretion to

stipulate repayment of the WCDLs in installments or by way So, borrowers will not only pay interest on the 60 per cent

of a "bullet" repayment, subject to IRAC norms. Banks may loan component and drawings from CC limit, but may also

consider rollover of the WCLs at the request of the borrower, have to pay commitment charges on the unavailed CC limit.

subject to compliance with the extant IRAC norms. This system has already started impacting banks, mainly in

two ways. These are as under:

Risk weights for undrawn portion of cash credit

limits 1. Positive impact on net interest income:

Effective from April 1, 2019, the undrawn portion of cash

Before the implementation of Loan Delivery System

credit/ overdraft limits sanctioned to the aforesaid large

Mechanism of RBI the utilisation of limits by borrowers

borrowers, irrespective of whether unconditionally enjoying limits in large exposures (beyond Rs. 150 crore)

cancellable or not, shall attract a credit conversion factor

range between 25 to 50 percent. Moreover, quite often

of 20 percent. the utilisation of limits by very large and high

creditworthy customers remains at near zero levels for

Impact of Loan Delivery on Banks: the most part of the year with occasional blips when

Under the 'Loan System for Delivery of Bank Credit' the limit get utilised to the fullest extent.

guideline, in the case of borrowers having an aggregate

fund-based working capital limit of Rs. 150 crore and above As the average availment of limits was very low, hence

BANKING FINANCE | MARCH | 2021 | 27