Page 40 - IC46 addendum

P. 40

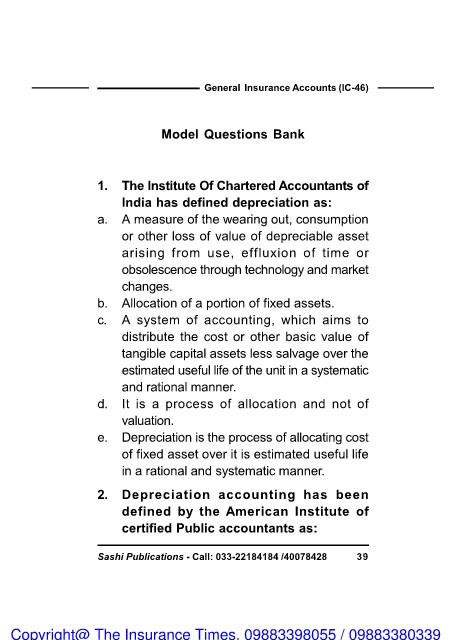

General Insurance Accounts (IC-46)

Model Questions Bank

1. The Institute Of Chartered Accountants of

India has defined depreciation as:

a. A measure of the wearing out, consumption

or other loss of value of depreciable asset

arising from use, effluxion of time or

obsolescence through technology and market

changes.

b. Allocation of a portion of fixed assets.

c. A system of accounting, which aims to

distribute the cost or other basic value of

tangible capital assets less salvage over the

estimated useful life of the unit in a systematic

and rational manner.

d. It is a process of allocation and not of

valuation.

e. Depreciation is the process of allocating cost

of fixed asset over it is estimated useful life

in a rational and systematic manner.

2. Depreciation accounting has been

defined by the American Institute of

certified Public accountants as:

Sashi Publications - Call: 033-22184184 /40078428 39

Copyright@ The Insurance Times. 09883398055 / 09883380339