Page 44 - IC46 addendum

P. 44

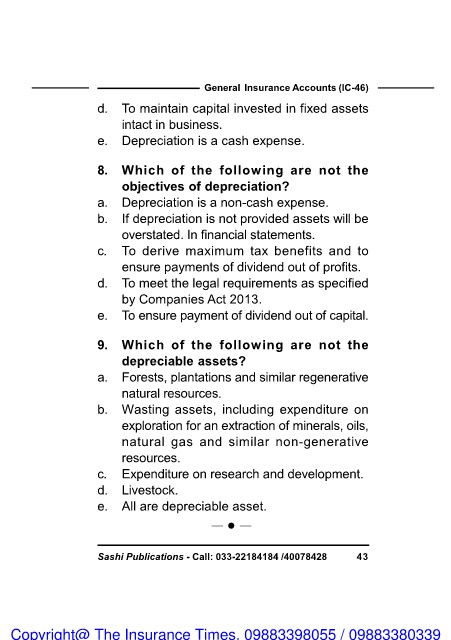

General Insurance Accounts (IC-46)

d. To maintain capital invested in fixed assets

intact in business.

e. Depreciation is a cash expense.

8. Which of the following are not the

objectives of depreciation?

a. Depreciation is a non-cash expense.

b. If depreciation is not provided assets will be

overstated. In financial statements.

c. To derive maximum tax benefits and to

ensure payments of dividend out of profits.

d. To meet the legal requirements as specified

by Companies Act 2013.

e. To ensure payment of dividend out of capital.

9. Which of the following are not the

depreciable assets?

a. Forests, plantations and similar regenerative

natural resources.

b. Wasting assets, including expenditure on

exploration for an extraction of minerals, oils,

natural gas and similar non-generative

resources.

c. Expenditure on research and development.

d. Livestock.

e. All are depreciable asset.

—l—

Sashi Publications - Call: 033-22184184 /40078428 43

Copyright@ The Insurance Times. 09883398055 / 09883380339