Page 49 - IC46 addendum

P. 49

The Insurance Times

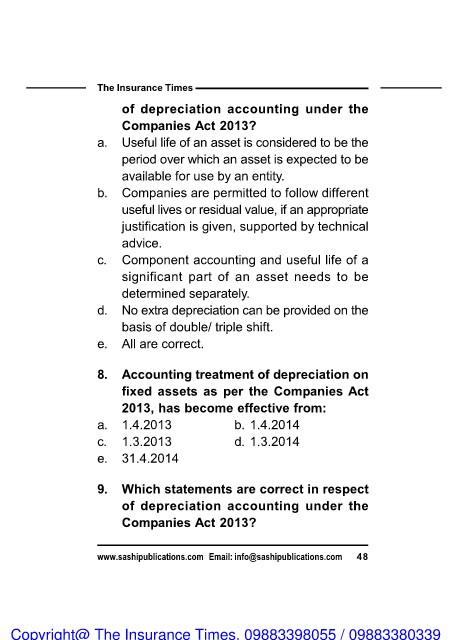

of depreciation accounting under the

Companies Act 2013?

a. Useful life of an asset is considered to be the

period over which an asset is expected to be

available for use by an entity.

b. Companies are permitted to follow different

useful lives or residual value, if an appropriate

justification is given, supported by technical

advice.

c. Component accounting and useful life of a

significant part of an asset needs to be

determined separately.

d. No extra depreciation can be provided on the

basis of double/ triple shift.

e. All are correct.

8. Accounting treatment of depreciation on

fixed assets as per the Companies Act

2013, has become effective from:

a. 1.4.2013 b. 1.4.2014

c. 1.3.2013 d. 1.3.2014

e. 31.4.2014

9. Which statements are correct in respect

of depreciation accounting under the

Companies Act 2013?

www.sashipublications.com Email: info@sashipublications.com 48

Copyright@ The Insurance Times. 09883398055 / 09883380339