Page 52 - IC46 addendum

P. 52

General Insurance Accounts (IC-46)

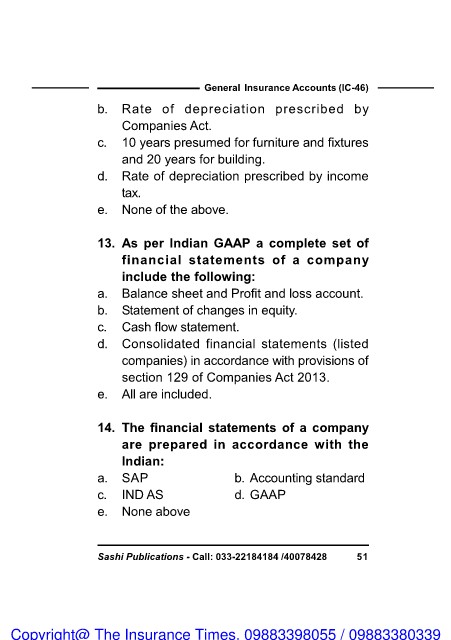

b. Rate of depreciation prescribed by

Companies Act.

c. 10 years presumed for furniture and fixtures

and 20 years for building.

d. Rate of depreciation prescribed by income

tax.

e. None of the above.

13. As per Indian GAAP a complete set of

financial statements of a company

include the following:

a. Balance sheet and Profit and loss account.

b. Statement of changes in equity.

c. Cash flow statement.

d. Consolidated financial statements (listed

companies) in accordance with provisions of

section 129 of Companies Act 2013.

e. All are included.

14. The financial statements of a company

are prepared in accordance with the

Indian:

a. SAP b. Accounting standard

c. IND AS d. GAAP

e. None above

Sashi Publications - Call: 033-22184184 /40078428 51

Copyright@ The Insurance Times. 09883398055 / 09883380339