Page 51 - IC46 addendum

P. 51

The Insurance Times

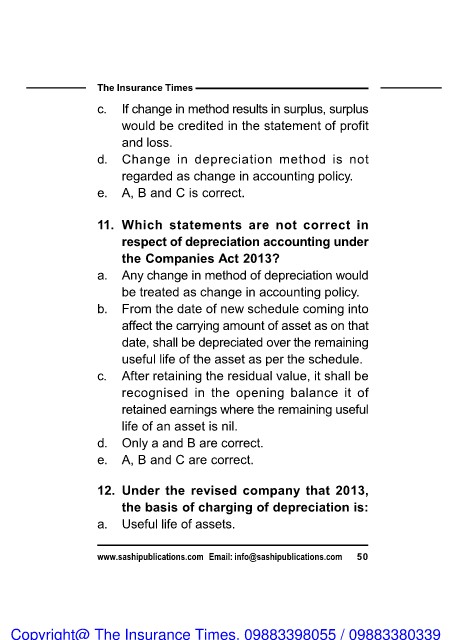

c. If change in method results in surplus, surplus

would be credited in the statement of profit

and loss.

d. Change in depreciation method is not

regarded as change in accounting policy.

e. A, B and C is correct.

11. Which statements are not correct in

respect of depreciation accounting under

the Companies Act 2013?

a. Any change in method of depreciation would

be treated as change in accounting policy.

b. From the date of new schedule coming into

affect the carrying amount of asset as on that

date, shall be depreciated over the remaining

useful life of the asset as per the schedule.

c. After retaining the residual value, it shall be

recognised in the opening balance it of

retained earnings where the remaining useful

life of an asset is nil.

d. Only a and B are correct.

e. A, B and C are correct.

12. Under the revised company that 2013,

the basis of charging of depreciation is:

a. Useful life of assets.

www.sashipublications.com Email: info@sashipublications.com 50

Copyright@ The Insurance Times. 09883398055 / 09883380339