Page 50 - IC46 addendum

P. 50

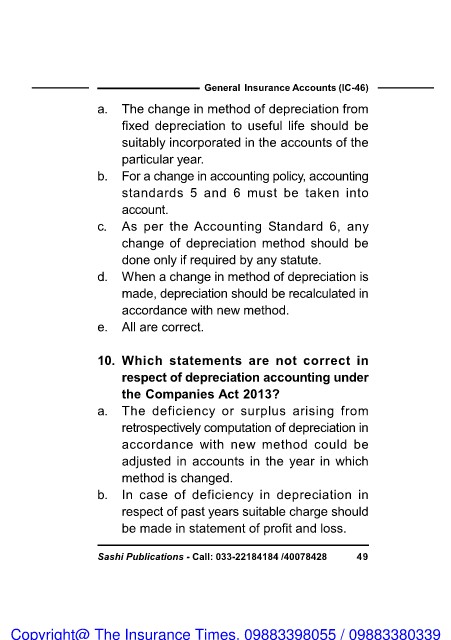

General Insurance Accounts (IC-46)

a. The change in method of depreciation from

fixed depreciation to useful life should be

suitably incorporated in the accounts of the

particular year.

b. For a change in accounting policy, accounting

standards 5 and 6 must be taken into

account.

c. As per the Accounting Standard 6, any

change of depreciation method should be

done only if required by any statute.

d. When a change in method of depreciation is

made, depreciation should be recalculated in

accordance with new method.

e. All are correct.

10. Which statements are not correct in

respect of depreciation accounting under

the Companies Act 2013?

a. The deficiency or surplus arising from

retrospectively computation of depreciation in

accordance with new method could be

adjusted in accounts in the year in which

method is changed.

b. In case of deficiency in depreciation in

respect of past years suitable charge should

be made in statement of profit and loss.

Sashi Publications - Call: 033-22184184 /40078428 49

Copyright@ The Insurance Times. 09883398055 / 09883380339