Page 33 - Insurance Times June 2023

P. 33

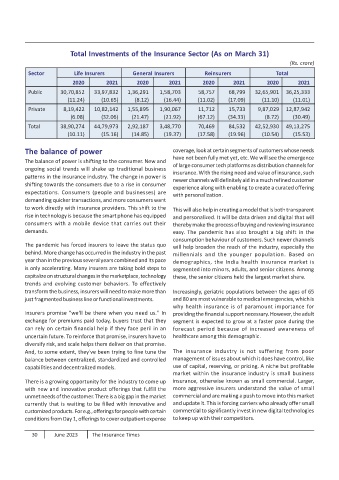

Total Investments of the Insurance Sector (As on March 31)

(Rs. crore)

Sector Life Insurers General Insurers Reinsurers Total

2020 2021 2020 2021 2020 2021 2020 2021

Public 30,70,852 33,97,832 1,36,291 1,58,703 58,757 68,799 32,65,901 36,25,333

(11.24) (10.65) (8.12) (16.44) (11.02) (17.09) (11.10) (11.01)

Private 8,19,422 10,82,142 1,55,895 1,90,067 11,712 15,733 9,87,029 12,87,942

(6.08) (32.06) (21.47) (21.92) (67.12) (34.33) (8.72) (30.49)

Total 38,90,274 44,79,973 2,92,187 3,48,770 70,469 84,532 42,52,930 49,13,275

(10.11) (15.16) (14.85) (19.37) (17.58) (19.96) (10.54) (15.53)

The balance of power coverage, look at certain segments of customers whose needs

have not been fully met yet, etc. We will see the emergence

The balance of power is shifting to the consumer. New and

of large consumer tech platforms as distribution channels for

ongoing social trends will shake up traditional business

insurance. With the rising need and value of insurance, such

patterns in the insurance industry. The change in power is

newer channels will definitely aid in a much refined customer

shifting towards the consumers due to a rise in consumer

experience along with enabling to create a curated offering

expectations. Consumers (people and businesses) are

with personalization.

demanding quicker transactions, and more consumers want

to work directly with insurance providers. This shift to the

This will also help in creating a model that is both transparent

rise in technology is because the smart phone has equipped

and personalized. It will be data driven and digital that will

consumers with a mobile device that carries out their thereby make the process of buying and reviewing insurance

demands. easy. The pandemic has also brought a big shift in the

consumption behaviour of customers. Such newer channels

The pandemic has forced insurers to leave the status quo

will help broaden the reach of the industry, especially the

behind. More change has occurred in the industry in the past

millennials and the younger population. Based on

year than in the previous several years combined and its pace demographics, the India health insurance market is

is only accelerating. Many insurers are taking bold steps to segmented into minors, adults, and senior citizens. Among

capitalize on structural changes in the marketplace, technology these, the senior citizens held the largest market share.

trends and evolving customer behaviors. To effectively

transform the business, insurers will need to make more than Increasingly, geriatric populations between the ages of 65

just fragmented business line or functional investments. and 80 are most vulnerable to medical emergencies, which is

why health insurance is of paramount importance for

Insurers promise "we'll be there when you need us." In providing the financial support necessary. However, the adult

exchange for premiums paid today, buyers trust that they segment is expected to grow at a faster pace during the

can rely on certain financial help if they face peril in an forecast period because of increased awareness of

uncertain future. To reinforce that promise, insurers have to healthcare among this demographic.

diversify risk, and scale helps them deliver on that promise.

And, to some extent, they've been trying to fine tune the The insurance industry is not suffering from poor

balance between centralized, standardized and controlled management of issues about which it does have control, like

capabilities and decentralized models. use of capital, reserving, or pricing. A niche but profitable

market within the insurance industry is small business

There is a growing opportunity for the industry to come up insurance, otherwise known as small commercial. Larger,

with new and innovative product offerings that fulfill the more aggressive insurers understand the value of small

unmet needs of the customer. There is a big gap in the market commercial and are making a push to move into this market

currently that is waiting to be filled with innovative and and update it. This is forcing carriers who already offer small

customized products. For e.g., offerings for people with certain commercial to significantly invest in new digital technologies

conditions from Day 1, offerings to cover outpatient expense to keep up with their competitors.

30 June 2023 The Insurance Times