Page 34 - Insurance Times June 2023

P. 34

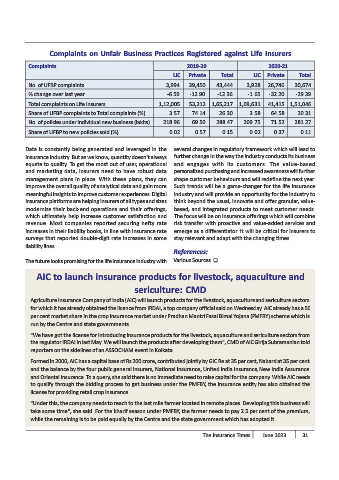

Complaints on Unfair Business Practices Registered against Life Insurers

Complaints 2019-20 2020-21

LIC Private Total LIC Private Total

No. of UFBP complaints 3,994 39,450 43,444 3,928 26,746 30,674

% change over last year -6.59 -12.90 -12.36 -1.65 -32.20 -29.39

Total complaints on Life Insurers 1,12,005 53,212 1,65,217 1,09,631 41,415 1,51,046

Share of UFBP complaints to Total complaints (%) 3.57 74.14 26.30 3.58 64.58 20.31

No. of policies under individual new business (lakhs) 218.96 69.50 288.47 209.75 71.52 281.27

Share of UFBP to new policies sold (%) 0.02 0.57 0.15 0.02 0.37 0.11

Data is constantly being generated and leveraged in the several changes in regulatory framework which will lead to

insurance industry. But as we know, quantity doesn't always further change in the way the industry conducts its business

equate to quality. To get the most out of user, operational and engages with its customers. The value-based

and marketing data, insurers need to have robust data personalized purchasing and increased awareness will further

management plans in place. With these plans, they can shape customer behaviours and will redefine the next year.

improve the overall quality of analytical data and gain more Such trends will be a game-changer for the life insurance

meaningful insights to improve customer experiences. Digital industry and will provide an opportunity for the industry to

insurance platforms are helping insurers of all types and sizes think beyond the usual, innovate and offer granular, value-

modernize their back-end operations and their offerings, based, and integrated products to meet customer needs.

which ultimately help increase customer satisfaction and The focus will be on insurance offerings which will combine

revenue. Most companies reported securing hefty rate risk transfer with proactive and value-added services and

increases in their liability books, in line with insurance rate emerge as a differentiator. It will be critical for insurers to

surveys that reported double-digit rate increases in some stay relevant and adapt with the changing times.

liability lines.

References:

The future looks promising for the life insurance industry with Various Sources.

AIC to launch insurance products for livestock, aquaculture and

sericulture: CMD

Agriculture Insurance Company of India (AIC) will launch products for the livestock, aquaculture and sericulture sectors

for which it has already obtained the licence from IRDAI, a top company official said on Wednesday. AIC already has a 50

per cent market share in the crop insurance market under Pradhan Mantri Fasal Bimal Yojana (PMFBY) scheme which is

run by the Centre and state governments.

"We have got the license for introducing insurance products for the livestock, aquaculture and sericulture sectors from

the regulator IRDAI in last May. We will launch the products after developing them", CMD of AIC Girija Subramanian told

reporters on the sidelines of an ASSOCHAM event in Kolkata.

Formed in 2000, AIC has a capital base of Rs 200 crore, contributed jointly by GIC Re at 35 per cent, Nabard at 35 per cent

and the balance by the four public general insurers, National Insurance, United India Insurance, New India Assurance

and Oriental Insurance. To a query, she said there is no immediate need to raise capital for the company. While AIC needs

to qualify through the bidding process to get business under the PMFBY, the insurance entity has also obtained the

license for providing retail crop insurance.

"Under this, the company needs to reach to the last mile farmer located in remote places. Developing this business will

take some time", she said. For the kharif season under PMFBY, the farmer needs to pay 2.5 per cent of the premium,

while the remaining is to be paid equally by the Centre and the state government which has adopted it.

The Insurance Times June 2023 31