Page 36 - Insurance Times December 2018

P. 36

As of January'18 we have 3.62 crores Credit Card Holders be willing to accept renewal from even third parties.

and a whopping 84.67 crores Debit Card Holders. Post

Demonetization Govt. Initiate series to steps to promote Online Portals

Digital Payments and it is quite evident that for January'18 IRDAI has launched a website http://isnp.irda.gov.in to

Credit Card registered transactions worth 41437 crores and promote E-commerce in insurance space which will lower

Debit Card to a tune of 40761 crores. We are seeing spike the cost of transaction and bring higher efficiency thus

in terms of number of transactions in both the segments benefitting the customers with discounts.

viz. Debit Card and Credit Card.

E-commerce is seen as an effective medium to increase

Insurance Companies have swiping machines at the branches insurance penetration and bring financial inclusion in a cost-

which are utilized by policy holders to pay back the new as efficient manner.

well as renewal premiums. Policy holders have the option to

pay the premium through debit or credit cards. Also IRDAI has licensed 24 Web Aggregators who provide

services to customers. These Web Aggregators primarily

Insurance companies may insist on policy holder paying the work on lead generation and pass on to the concerned

first premium to ensure insurable interest exists and may insurance company.

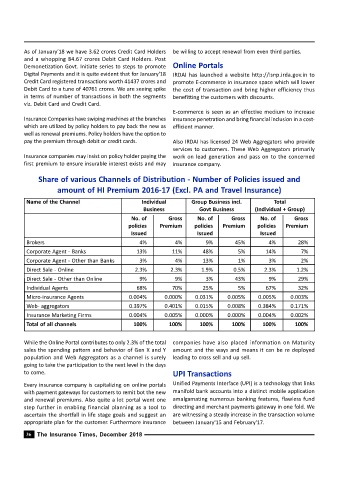

Share of various Channels of Distribution - Number of Policies issued and

amount of HI Premium 2016-17 (Excl. PA and Travel Insurance)

Name of the Channel Individual Group Business incl. Total

Business Govt Business (Individual + Group)

No. of Gross No. of Gross No. of Gross

policies Premium policies Premium policies Premium

Issued Issued Issued

Brokers 4% 4% 9% 45% 4% 28%

Corporate Agent - Banks 13% 11% 48% 5% 14% 7%

Corporate Agent - Other than Banks 3% 4% 13% 1% 3% 2%

Direct Sale - Online 2.3% 2.3% 1.9% 0.5% 2.3% 1.2%

Direct Sale - Other than Online 9% 9% 3% 43% 9% 29%

Individual Agents 68% 70% 25% 5% 67% 32%

Micro-insurance Agents 0.004% 0.000% 0.031% 0.005% 0.005% 0.003%

Web- aggregators 0.397% 0.401% 0.015% 0.008% 0.384% 0.171%

Insurance Marketing Firms 0.004% 0.005% 0.000% 0.000% 0.004% 0.002%

Total of all channels 100% 100% 100% 100% 100% 100%

While the Online Portal contributes to only 2.3% of the total companies have also placed information on Maturity

sales the spending pattern and behavior of Gen X and Y amount and the ways and means it can be re deployed

population and Web Aggregators as a channel is surely leading to cross sell and up sell.

going to take the participation to the next level in the days

to come. UPI Transactions

Every insurance company is capitalizing on online portals Unified Payments Interface (UPI) is a technology that links

with payment gateways for customers to remit bot the new manifold bank accounts into a distinct mobile application

and renewal premiums. Also quite a lot portal went one amalgamating numerous banking features, flawless fund

step further in enabling financial planning as a tool to directing and merchant payments gateway in one fold. We

ascertain the shortfall in life stage goals and suggest an are witnessing a steady increase in the transaction volume

appropriate plan for the customer. Furthermore insurance between January'15 and February'17.

36 The Insurance Times, December 2018