Page 33 - Life Insurance Today July - December 2020

P. 33

Year Life Non-Life Industry

Density Penetration Density Penetration Density Penetration

(USD) (Percentage) (USD) (Percentage) (USD) (Percentage)

2015 43.20 2.72 11.50 0.72 54.70 3.44

2016 46.50 2.72 13.20 0.77 59.70 3.49

2017 55.00 2.76 18.00 0.93 73.00 3.69

2018 55.00 2.74 19.00 0.97 74.00 3.70

Source: Annual Report of IRDA, 2018-19

Note 1: Insurance Density is measured as a ratio of premium (in USD) in total Population

2. Insurance penetration is measured as ratio of premium (in USD) to GDP (in USD)

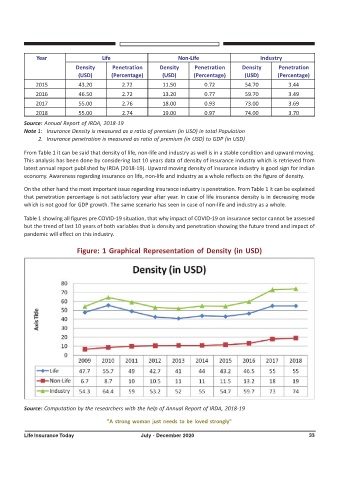

From Table 1 it can be said that density of life, non-life and industry as well is in a stable condition and upward moving.

This analysis has been done by considering last 10 years data of density of insurance industry which is retrieved from

latest annual report published by IRDA (2018-19). Upward moving density of insurance industry is good sign for Indian

economy. Awareness regarding insurance on life, non-life and industry as a whole reflects on the figure of density.

On the other hand the most important issue regarding insurance industry is penetration. From Table 1 it can be explained

that penetration percentage is not satisfactory year after year. In case of life insurance density is in decreasing mode

which is not good for GDP growth. The same scenario has seen in case of non-life and industry as a whole.

Table 1 showing all figures pre COVID-19 situation, that why impact of COVID-19 on insurance sector cannot be assessed

but the trend of last 10 years of both variables that is density and penetration showing the future trend and impact of

pandemic will effect on this industry.

Figure: 1 Graphical Representation of Density (in USD)

Source: Computation by the researchers with the help of Annual Report of IRDA, 2018-19

"A strong woman just needs to be loved strongly"

Life Insurance Today July - December 2020 33