Page 32 - Life Insurance Today July - December 2020

P. 32

through insurance in human life cycle can be made easy. 3. Research Gap:

People need different amount of monetary funds at

After reviewing so many research paper and different

different point of time in their life for accomplishing

articles and searching in websites researchers came to

different needs. These human needs may be fulfilled with

know that very little work is done in insurance sector as a

the help of insurance planning.

whole or it can be said that insurance penetration and

insurance density have not considered by earlier researcher

Radhika (2019) expressed her view through the article

for their analysis purpose. So that point of view this

named "A study on life insurance penetration in India" that

research has made an attempt to analysis the insurance

penetration in life insurance sector is most common and

sector in India by considering the data for last 10 years.

effective issue and researcher pointed out the corrective

measures to improve the penetration.

4. Objectives :

Vimala and Alamelu (2018) talked their views in their i. To understand the basic idea of Insurance density and

article, "Insurance Penetration and Insurance Density in Insurance penetration in insurance sector in India

India - An Analysis" regarding insurance penetration and ii. To identify the growth of this Industry and factors

insurance density. Researchers' have considered the data effecting for this purpose

of seven years for these two important issues in insurance

sector and have used some arithmetical and statistical tool 5. Research Methodology:

for analysis of the objectives.

This study is fully based on secondary data. The data for

this purpose have been collected from IRDA websites. Other

Rajasekhar and Hymavathi Kumari (2014) in their study

than this some published journals from the Insurance

titled "Life insurance Industry in India-An overview"

Institute of India (III) have considered for literature review

measures the performance of life insurance industry in India

purpose.

and its potential growth for the period of 2001-02 to 2010-

11.

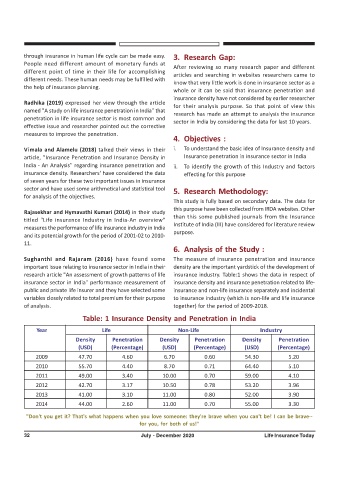

6. Analysis of the Study :

Sughanthi and Rajaram (2016) have found some The measure of insurance penetration and insurance

important issue relating to insurance sector in India in their density are the important yardstick of the development of

research article "An assessment of growth patterns of life insurance industry. Table:1 shows the data in respect of

insurance sector in India" performance measurement of insurance density and insurance penetration related to life-

public and private life insurer and they have selected some insurance and non-life insurance separately and incidental

variables closely related to total premium for their purpose to insurance industry (which is non-life and life insurance

of analysis. together) for the period of 2009-2018.

Table: 1 Insurance Density and Penetration in India

Year Life Non-Life Industry

Density Penetration Density Penetration Density Penetration

(USD) (Percentage) (USD) (Percentage) (USD) (Percentage)

2009 47.70 4.60 6.70 0.60 54.30 5.20

2010 55.70 4.40 8.70 0.71 64.40 5.10

2011 49.00 3.40 10.00 0.70 59.00 4.10

2012 42.70 3.17 10.50 0.78 53.20 3.96

2013 41.00 3.10 11.00 0.80 52.00 3.90

2014 44.00 2.60 11.00 0.70 55.00 3.30

"Don't you get it? That's what happens when you love someone: they're brave when you can't be! I can be brave--

for you, for both of us!"

32 July - December 2020 Life Insurance Today