Page 12 - Insurance Statistics 2021

P. 12

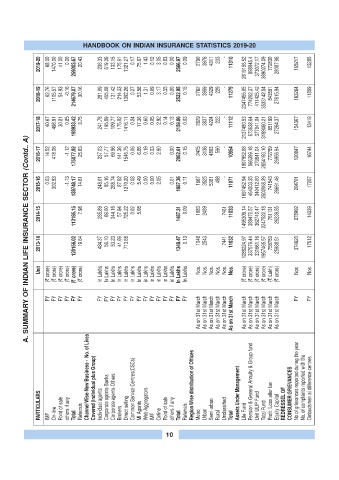

HANDBOOK ON INDIAN INSURANCE STATISTICS 2019-20

2019-20 68.00 1470.00 41.00 0.00 259003.67 20.43 236.33 619.06 133.15 175.91 1321.27 0.17 75.67 1.43 0.12 3.05 0.83 0.00 2566.97 0.09 2790 3976 4311 233 - 11310 2619156.52 898045.4 373072.17 3890274.09 772830 28087.96 165217 13285

2018-19 62.76 1105.57 54.93 -0.16 214679.07 30.16 281.09 455.08 131.42 214.33 1392.26 0.27 53.58 1.31 0.09 3.17 0.35 0.00 2532.95 0.15 2762 3959 4329 229 - 11279 2347455.05 774262.37 411425.42 3533142.84 843581 27615.94 163264 11859

2017-18 40.67 498.91 30.81 0.85 193933.42 3.75 241.78 195.89 109.77 175.02 1416.11 0.24 17.36 0.60 0.05 2.92 0.14 0.13 2159.86 0.03 2829 3837 4224 222 - 11112 2137480.53 673638.64 377941.04 3189060.21 851199 27264.37 154367 13419

A. SUMMARY OF INDIAN LIFE INSURANCE SECTOR (Contd.. A)

2016-17 14.52 418.06 -1.12 175077.92 25.83 237.03 57.77 69.96 141.36 1546.75 0.06 6.86 0.19 0.03 2.60 0.00 2062.61 0.15 2425 3136 4803 590 - 10954 1907952.88 566399.18 379841.04 2854193.10 772789 26956.94 120847 16744

2015-16 0.03 302.83 -1.13 138748.17 14.61 248.01 85.16 288.74 87.62 1270.20 0.08 5.49 0.00 0.00 2.05 0.01 1987.36 0.11 1667 3525 5381 498 - 11071 1697452.94 464203.35 340412.00 2502068.29 741543 26691.46 204701 17257

2014-15 113185.15 7.98 285.89 69.00 344.16 57.94 725.22 0.02 5.08 1487.31 0.09 1083 2489 7461 11033 1495309.14 389472.57 362740.47 2247522.18 761131 26239.55 278992 14339

2013-14 120156.02 19.64 484.37 56.10 53.23 41.09 713.68 1348.47 0.13 1048 2543 7441 11032 1288224.97 337579.44 331661.16 1957465.57 758783 25938.51 374620 17512

(? crore) (? crore) (? crore) (? crore) (? crore) (? crore) In Lakhs In Lakhs In Lakhs In Lakhs In Lakhs In Lakhs In Lakhs in Lakhs in Lakhs in Lakhs in Lakhs in Lakhs In Lakhs In Lakhs (? crore) (? crore) (? crore) (? crore) (? Lakh) (? crore)

Unit Nos. Nos. Nos. Nos. Nos. Nos. Nos. Nos.

As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March As on 31st March

FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY FY

Channel Wise-New Business - No. of Lives Covered (Individual plus Group) Common Service Centres(CSCs) Region Wise distribution of Offices Pension & General Annuity & Group fund No of grievances reported during the year No. of complaints reported with the Ombudsmen at difference centres

PARTICULARS IMF On-line Point of sale others if any Total Referrals Individual agents Corporate agents-Banks Corporate agents-Others Brokers Direct selling MI Agents Web Aggregators IMF Online Point of sale others if any Total Referrals Metro Urban Semi-urban Rural Unclassified Total Assets Under Management Life Fund Unit ULIP Fund Total Fund Profit /Loss after tax Equity Capital REDRESSEL OF CONSUMER GRIEVANCES

10