Page 31 - Banking Finance March 2019

P. 31

ARTICLE

Mulki Sunder Ram Shetty, the then the Chief Executive of Total Deposits is highest in Bank of Baroda. Non-performing

the bank. The bank was nationalized on 15th April 1980. Assets amount, percentage-wise and Capital Risk Assets Ratio

The bank has built in network of 2136 Branches and 2155 (CRAR) is Good in Vijaya Bank when compared to other TWO

ATMs as on 31.03.2018, that span all States and Union Banks. Per Employee / Branch Business is highest in Bank of

Territories in the country. Baroda followed by Vijaya Bank and Dena Bank.

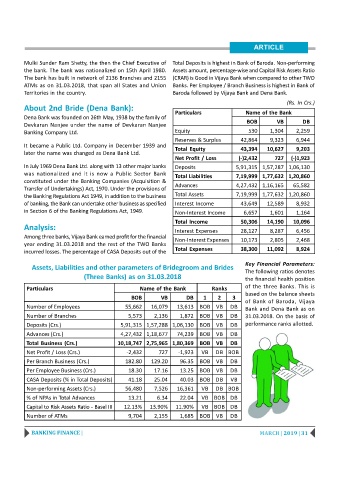

(Rs. In Crs.)

About 2nd Bride (Dena Bank):

Particulars Name of the Bank

Dena Bank was founded on 26th May, 1938 by the family of

Devkaran Nanjee under the name of Devkaran Nanjee BOB VB DB

Banking Company Ltd. Equity 530 1,304 2,259

Reserves & Surplus 42,864 9,323 6,944

It became a Public Ltd. Company in December 1939 and

Total Equity 43,394 10,627 9,203

later the name was changed as Dena Bank Ltd.

Net Profit / Loss (-)2,432 727 (-)1,923

In July 1969 Dena Bank Ltd. along with 13 other major banks Deposits 5,91,315 1,57,287 1,06,130

was nationalized and it is now a Public Sector Bank Total Liabilities 7,19,999 1,77,632 1,20,860

constituted under the Banking Companies (Acquisition &

Transfer of Undertakings) Act, 1970. Under the provisions of Advances 4,27,432 1,16,165 65,582

the Banking Regulations Act 1949, in addition to the business Total Assets 7,19,999 1,77,632 1,20,860

of banking, the Bank can undertake other business as specified Interest Income 43,649 12,589 8,932

in Section 6 of the Banking Regulations Act, 1949. Non-Interest Income 6,657 1,601 1,164

Total Income 50,306 14,190 10,096

Analysis:

Interest Expenses 28,127 8,287 6,456

Among three banks, Vijaya Bank earned profit for the financial

Non-Interest Expenses 10,173 2,805 2,468

year ending 31.03.2018 and the rest of the TWO Banks

Total Expenses 38,300 11,092 8,924

incurred losses. The percentage of CASA Deposits out of the

Key Financial Parameters:

Assets, Liabilities and other parameters of Bridegroom and Brides

The following ratios denotes

(Three Banks) as on 31.03.2018 the financial health position

Particulars Name of the Bank Ranks of the three Banks. This is

based on the balance sheets

BOB VB DB 1 2 3

of Bank of Baroda, Vijaya

Number of Employees 55,662 16,079 13,613 BOB VB DB Bank and Dena Bank as on

Number of Branches 5,573 2,136 1,872 BOB VB DB 31.03.2018. On the basis of

Deposits (Crs.) 5,91,315 1,57,288 1,06,130 BOB VB DB performance ranks allotted.

Advances (Crs.) 4,27,432 1,18,677 74,239 BOB VB DB

Total Business (Crs.) 10,18,747 2,75,965 1,80,369 BOB VB DB

Net Profit / Loss (Crs.) -2,432 727 -1,923 VB DB BOB

Per Branch Business (Crs.) 182.80 129.20 96.35 BOB VB DB

Per Employee Business (Crs.) 18.30 17.16 13.25 BOB VB DB

CASA Deposits (% in Total Deposits) 41.18 25.04 40.03 BOB DB VB

Non-performing Assets (Crs.) 56,480 7,526 16,361 VB DB BOB

% of NPAs in Total Advances 13.21 6.34 22.04 VB BOB DB

Capital to Risk Assets Ratio - Basel III 12.13% 13.90% 11.90% VB BOB DB

Number of ATMs 9,704 2,155 1,685 BOB VB DB

BANKING FINANCE | MARCH | 2019 | 31