Page 35 - Banking Finance March 2019

P. 35

ARTICLE

foreign exchange business. The percentage of interest

expenditure of Dena Bank is more out of the income

generated by the bank. Among three, Bank of Baroda is

incurred 55.91% as Interest Expenses out of Total income

earned by the bank.

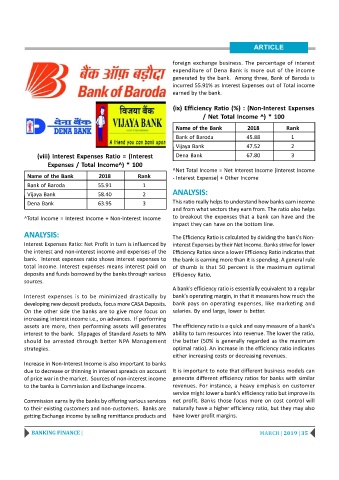

(ix) Efficiency Ratio (%) : (Non-Interest Expenses

/ Net Total Income ^) * 100

Name of the Bank 2018 Rank

Bank of Baroda 45.88 1

Vijaya Bank 47.52 2

(viii) Interest Expenses Ratio = (Interest Dena Bank 67.80 3

Expenses / Total Income^) * 100

^Net Total Income = Net Interest Income (Interest Income

Name of the Bank 2018 Rank - Interest Expense) + Other Income

Bank of Baroda 55.91 1

Vijaya Bank 58.40 2 ANALYSIS:

Dena Bank 63.95 3 This ratio really helps to understand how banks earn income

and from what sectors they earn from. The ratio also helps

^Total Income = Interest Income + Non-Interest Income to breakout the expenses that a bank can have and the

impact they can have on the bottom line.

ANALYSIS: The Efficiency Ratio is calculated by dividing the bank's Non-

Interest Expenses Ratio: Net Profit in turn is influenced by interest Expenses by their Net Income. Banks strive for lower

the interest and non-interest income and expenses of the Efficiency Ratios since a lower Efficiency Ratio indicates that

bank. Interest expenses ratio shows interest expenses to the bank is earning more than it is spending. A general rule

total income. Interest expenses means interest paid on of thumb is that 50 percent is the maximum optimal

deposits and funds borrowed by the banks through various Efficiency Ratio,

sources.

A bank's efficiency ratio is essentially equivalent to a regular

Interest expenses is to be minimized drastically by bank's operating margin, in that it measures how much the

developing new deposit products, focus more CASA Deposits. bank pays on operating expenses, like marketing and

On the other side the banks are to give more focus on salaries. By and large, lower is better.

increasing interest income i.e., on advances. If performing

assets are more, then performing assets will generates The efficiency ratio is a quick and easy measure of a bank's

interest to the bank. Slippages of Standard Assets to NPA ability to turn resources into revenue. The lower the ratio,

should be arrested through better NPA Management the better (50% is generally regarded as the maximum

strategies. optimal ratio). An increase in the efficiency ratio indicates

either increasing costs or decreasing revenues.

Increase in Non-Interest Income is also important to banks

due to decrease or thinning in interest spreads on account It is important to note that different business models can

of price war in the market. Sources of non-interest income generate different efficiency ratios for banks with similar

to the banks is Commission and Exchange income. revenues. For instance, a heavy emphasis on customer

service might lower a bank's efficiency ratio but improve its

Commission earns by the banks by offering various services net profit. Banks those focus more on cost control will

to their existing customers and non-customers. Banks are naturally have a higher efficiency ratio, but they may also

getting Exchange income by selling remittance products and have lower profit margins.

BANKING FINANCE | MARCH | 2019 | 35