Page 49 - Insurance Times June 2019

P. 49

Circular

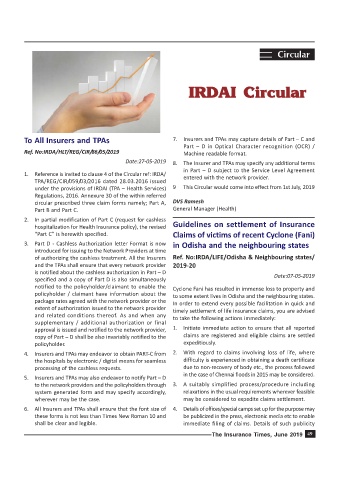

IRDAI Circular

To All Insurers and TPAs 7. Insurers and TPAs may capture details of Part – C and

Part – D in Optical Character recognition (OCR) /

Ref. No:IRDA/HLT/REG/CIR/86/05/2019 Machine readable format.

Date:27-05-2019

8. The Insurer and TPAs may specify any additional terms

in Part – D subject to the Service Level Agreement

1. Reference is invited to clause 4 of the Circular ref: IRDA/

entered with the network provider.

TPA/REG/CIR/059/03/2016 dated 28.03.2016 issued

9 This Circular would come into effect from 1st July, 2019

under the provisions of IRDAI (TPA – Health Services)

Regulations, 2016. Annexure 30 of the within referred

circular prescribed three claim forms namely; Part A, DVS Ramesh

Part B and Part C. General Manager (Health)

2. In partial modification of Part C (request for cashless

Guidelines on settlement of Insurance

hospitalization for Health Insurance policy), the revised

“Part C” is herewith specified. Claims of victims of recent Cyclone (Fani)

3. Part D - Cashless Authorization letter Format is now

in Odisha and the neighbouring states

introduced for issuing to the Network Providers at time

of authorizing the cashless treatment. All the Insurers Ref. No:IRDA/LIFE/Odisha & Neighbouring states/

and the TPAs shall ensure that every network provider 2019-20

is notified about the cashless authorization in Part – D

Date:07-05-2019

specified and a copy of Part D is also simultaneously

notified to the policyholder/claimant to enable the

Cyclone Fani has resulted in immense loss to property and

policyholder / claimant have information about the

to some extent lives in Odisha and the neighbouring states.

package rates agreed with the network provider or the

In order to extend every possible facilitation in quick and

extent of authorization issued to the network provider

timely settlement of life insurance claims, you are advised

and related conditions thereof. As and when any

to take the following actions immediately:

supplementary / additional authorization or final

1. Initiate immediate action to ensure that all reported

approval is issued and notified to the network provider,

claims are registered and eligible claims are settled

copy of Part – D shall be also invariably notified to the

policyholder. expeditiously.

4. Insurers and TPAs may endeavor to obtain PART-C from 2. With regard to claims involving loss of life, where

the hospitals by electronic / digital means for seamless difficulty is experienced in obtaining a death certificate

processing of the cashless requests. due to non-recovery of body etc., the process followed

in the case of Chennai floods in 2015 may be considered.

5. Insurers and TPAs may also endeavor to notify Part – D

to the network providers and the policyholders through 3. A suitably simplified process/procedure including

system generated form and may specify accordingly, relaxations in the usual requirements wherever feasible

wherever may be the case. may be considered to expedite claims settlement.

6. All Insurers and TPAs shall ensure that the font size of 4. Details of offices/special camps set up for the purpose may

these forms is not less than Times New Roman 10 and be publicized in the press, electronic media etc to enable

shall be clear and legible. immediate filing of claims. Details of such publicity

The Insurance Times, June 2019 49