Page 35 - Insurance Times December 2019

P. 35

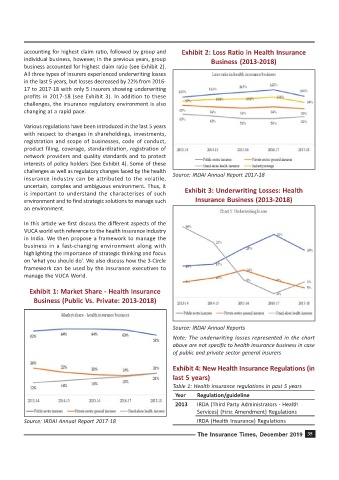

accounting for highest claim ratio, followed by group and Exhibit 2: Loss Ratio in Health Insurance

individual business, however, in the previous years, group Business (2013-2018)

business accounted for highest claim ratio (see Exhibit 2).

All three types of insurers experienced underwriting losses

in the last 5 years, but losses decreased by 22% from 2016-

17 to 2017-18 with only 5 insurers showing underwriting

profits in 2017-18 (see Exhibit 3). In addition to these

challenges, the insurance regulatory environment is also

changing at a rapid pace.

Various regulations have been introduced in the last 5 years

with respect to changes in shareholdings, investments,

registration and scope of businesses, code of conduct,

product filing, coverage, standardization, registration of

network providers and quality standards and to protect

interests of policy holders (See Exhibit 4). Some of these

challenges as well as regulatory changes faced by the health

Source: IRDAI Annual Report 2017-18

insurance industry can be attributed to the volatile,

uncertain, complex and ambiguous environment. Thus, it

is important to understand the characterises of such Exhibit 3: Underwriting Losses: Health

environment and to find strategic solutions to manage such Insurance Business (2013-2018)

an environment.

In this article we first discuss the different aspects of the

VUCA world with reference to the health insurance industry

in India. We then propose a framework to manage the

business in a fast-changing environment along with

highlighting the importance of strategic thinking and focus

on 'what you should do'. We also discuss how the 3-Circle

framework can be used by the insurance executives to

manage the VUCA World.

Exhibit 1: Market Share - Health Insurance

Business (Public Vs. Private: 2013-2018)

Source: IRDAI Annual Reports

Note: The underwriting losses represented in the chart

above are not specific to health insurance business in case

of public and private sector general insurers

Exhibit 4: New Health Insurance Regulations (in

last 5 years)

Table 1: Health insurance regulations in past 5 years

Year Regulation/guideline

2013 IRDA (Third Party Administrators - Health

Services) (First Amendment) Regulations

Source: IRDAI Annual Report 2017-18 IRDA (Health Insurance) Regulations

The Insurance Times, December 2019 35