Page 40 - Insurance Times December 2019

P. 40

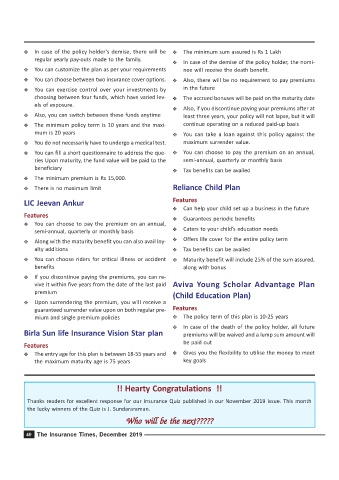

Y In case of the policy holder’s demise, there will be Y The minimum sum assured is Rs 1 Lakh

regular yearly pay-outs made to the family.

Y In case of the demise of the policy holder, the nomi-

Y You can customize the plan as per your requirements nee will receive the death benefit.

Y You can choose between two insurance cover options. Y Also, there will be no requirement to pay premiums

Y You can exercise control over your investments by in the future

choosing between four funds, which have varied lev- Y The accrued bonuses will be paid on the maturity date

els of exposure.

Y Also, if you discontinue paying your premiums after at

Y Also, you can switch between these funds anytime least three years, your policy will not lapse, but it will

Y The minimum policy term is 10 years and the maxi- continue operating on a reduced paid-up basis

mum is 20 years Y You can take a loan against this policy against the

Y You do not necessarily have to undergo a medical test. maximum surrender value.

Y You can fill a short questionnaire to address the que- Y You can choose to pay the premium on an annual,

ries Upon maturity, the fund value will be paid to the semi-annual, quarterly or monthly basis

beneficiary

Y Tax benefits can be availed

Y The minimum premium is Rs 15,000.

Y There is no maximum limit Reliance Child Plan

LIC Jeevan Ankur Features

Y Can help your child set up a business in the future

Features

Y Guarantees periodic benefits

Y You can choose to pay the premium on an annual,

semi-annual, quarterly or monthly basis Y Caters to your child’s education needs

Y Along with the maturity benefit you can also avail loy- Y Offers life cover for the entire policy term

alty additions Y Tax benefits can be availed

Y You can choose riders for critical illness or accident Y Maturity benefit will include 25% of the sum assured,

benefits along with bonus

Y If you discontinue paying the premiums, you can re-

vive it within five years from the date of the last paid Aviva Young Scholar Advantage Plan

premium

(Child Education Plan)

Y Upon surrendering the premium, you will receive a

guaranteed surrender value upon on both regular pre- Features

mium and single premium policies Y The policy term of this plan is 10-25 years

Y In case of the death of the policy holder, all future

Birla Sun life Insurance Vision Star plan premiums will be waived and a lump sum amount will

be paid out

Features

Y The entry age for this plan is between 18-55 years and Y Gives you the flexibility to utilise the money to meet

the maximum maturity age is 75 years key goals

!! Hearty Congratulations !!

Thanks readers for excellent response for our Insurance Quiz published in our November 2019 issue. This month

the lucky winners of the Quiz is J. Sundararaman.

Who will be the next?????

Who will be the next?????

Who will be the next?????

Who will be the next?????

Who will be the next?????

40 The Insurance Times, December 2019