Page 45 - Insurance Times December 2019

P. 45

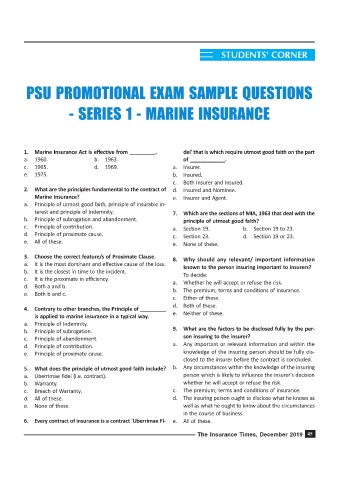

STUDENTS' CORNER

PSU PROMOTIONAL EXAM SAMPLE QUESTIONS

- SERIES 1 - MARINE INSURANCE

1. Marine Insurance Act is effective from _________. dei' that is which require utmost good faith on the part

a. 1960. b. 1963. of ____________.

c. 1965. d. 1969. a. Insurer.

e. 1975. b. Insured.

c. Both Insurer and Insured.

2. What are the principles fundamental to the contract of d. Insured and Nominee.

Marine Insurance? e. Insurer and Agent.

a. Principle of utmost good faith, principle of insurable in-

terest and principle of Indemnity. 7. Which are the sections of MIA, 1963 that deal with the

b. Principle of subrogation and abandonment. principle of utmost good faith?

c. Principle of contribution. a. Section 19. b. Section 19 to 23.

d. Principle of proximate cause. c. Section 23. d. Section 19 or 23.

e. All of these.

e. None of these.

3. Choose the correct feature/s of Proximate Clause.

8. Why should any relevant/ important information

a. It is the most dominant and effective cause of the loss.

known to the person insuring important to insurers?

b. It is the closest in time to the incident.

To decide:

c. It is the proximate in efficiency. a. Whether he will accept or refuse the risk.

d. Both a and b.

b. The premium, terms and conditions of insurance.

e. Both b and c.

c. Either of these.

d. Both of these.

4. Contrary to other branches, the Principle of _________

is applied to marine insurance in a typical way. e. Neither of these.

a. Principle of Indemnity.

b. Principle of subrogation. 9. What are the factors to be disclosed fully by the per-

son insuring to the insurer?

c. Principle of abandonment.

d. Principle of contribution. a. Any important or relevant information and within the

e. Principle of proximate cause. knowledge of the insuring person should be fully dis-

closed to the insurer before the contract is concluded.

5. What does the principle of utmost good faith include? b. Any circumstances within the knowledge of the insuring

a. Uberrimae fidei (i.e. contract). person which is likely to influence the insurer's decision

b. Warranty. whether he will accept or refuse the risk.

c. Breach of Warranty. c. The premium, terms and conditions of insurance.

d. All of these. d. The insuring person ought to disclose what he knows as

e. None of these. well as what he ought to know about the circumstances

in the course of business.

6. Every contract of insurance is a contract 'Uberrimae Fi- e. All of these.

The Insurance Times, December 2019 45