Page 35 - Insurance Times March 2019

P. 35

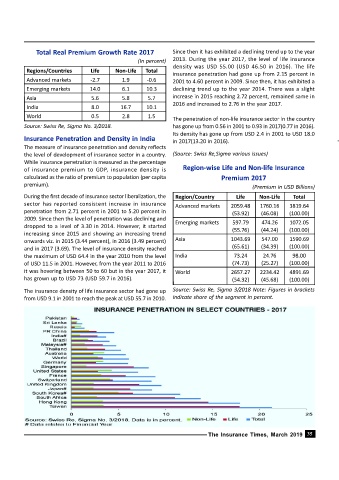

Total Real Premium Growth Rate 2017 Since then it has exhibited a declining trend up to the year

(In percent) 2013. During the year 2017, the level of life insurance

density was USD 55.00 (USD 46.50 in 2016). The life

Regions/Countries Life Non-Life Total

insurance penetration had gone up from 2.15 percent in

Advanced markets -2.7 1.9 -0.6 2001 to 4.60 percent in 2009. Since then, it has exhibited a

Emerging markets 14.0 6.1 10.3 declining trend up to the year 2014. There was a slight

Asia 5.6 5.8 5.7 increase in 2015 reaching 2.72 percent, remained same in

2016 and increased to 2.76 in the year 2017.

India 8.0 16.7 10.1

World 0.5 2.8 1.5

The penetration of non-life insurance sector in the country

Source: Swiss Re, Sigma No. 3/2018. has gone up from 0.56 in 2001 to 0.93 in 2017(0.77 in 2016).

Its density has gone up from USD 2.4 in 2001 to USD 18.0

Insurance Penetration and Density in India in 2017(13.20 in 2016).

The measure of insurance penetration and density reflects

the level of development of insurance sector in a country. (Source: Swiss Re,Sigma various issues)

While insurance penetration is measured as the percentage

of insurance premium to GDP, insurance density is Region-wise Life and Non-life Insurance

calculated as the ratio of premium to population (per capita Premium 2017

premium). (Premium in USD Billions)

During the first decade of insurance sector liberalization, the Region/Country Life Non-Life Total

sector has reported consistent increase in insurance Advanced markets 2059.48 1760.16 3819.64

penetration from 2.71 percent in 2001 to 5.20 percent in (53.92) (46.08) (100.00)

2009. Since then the level of penetration was declining and

Emerging markets 597.79 474.26 1072.05

dropped to a level of 3.30 in 2014. However, it started

(55.76) (44.24) (100.00)

increasing since 2015 and showing an increasing trend

onwards viz. in 2015 (3.44 percent), in 2016 (3.49 percent) Asia 1043.69 547.00 1590.69

and in 2017 (3.69). The level of insurance density reached (65.61) (34.39) (100.00)

the maximum of USD 64.4 in the year 2010 from the level India 73.24 24.76 98.00

of USD 11.5 in 2001. However, from the year 2011 to 2016 (74.73) (25.27) (100.00)

it was hovering between 50 to 60 but in the year 2017, it World 2657.27 2234.42 4891.69

has grown up to USD 73 (USD 59.7 in 2016). (54.32) (45.68) (100.00)

The insurance density of life insurance sector had gone up Source: Swiss Re, Sigma 3/2018 Note: Figures in brackets

from USD 9.1 in 2001 to reach the peak at USD 55.7 in 2010. indicate share of the segment in percent.

The Insurance Times, March 2019 35