Page 245 - Operations Strategy

P. 245

220 CHAPTER 6 • PRoCEss TECHnology sTRATEgy

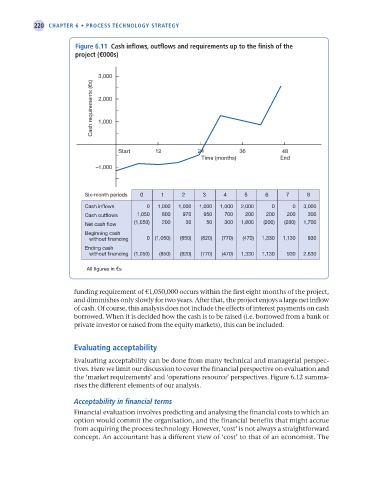

Figure 6.11 Cash inflows, outflows and requirements up to the finish of the

project (€000s)

3,000

Cash requirements (€s) 2,000

1,000

Start 12 24 36 48

Time (months) End

–1,000

Six-month periods 0 1 2 3 4 5 6 7 8

Cash inflows 0 1,000 1,000 1,000 1,000 2,000 0 0 3,000

Cash outflows 1,050 800 970 950 700 200 200 200 300

Net cash flow (1,050) 200 30 50 300 1,800 (200) (200) 1,700

Beginning cash

without financing 0 (1,050) (850) (820) (770) (470) 1,330 1,130 930

Ending cash

without financing (1,050) (850) (820) (770) (470) 1,330 1,130 930 2,630

All figures in €s

funding requirement of €1,050,000 occurs within the first eight months of the project,

and diminishes only slowly for two years. After that, the project enjoys a large net inflow

of cash. Of course, this analysis does not include the effects of interest payments on cash

borrowed. When it is decided how the cash is to be raised (i.e. borrowed from a bank or

private investor or raised from the equity markets), this can be included.

evaluating acceptability

Evaluating acceptability can be done from many technical and managerial perspec-

tives. Here we limit our discussion to cover the financial perspective on evaluation and

the ‘market requirements’ and ‘operations resource’ perspectives. Figure 6.12 summa-

rises the different elements of our analysis.

Acceptability in financial terms

Financial evaluation involves predicting and analysing the financial costs to which an

option would commit the organisation, and the financial benefits that might accrue

from acquiring the process technology. However, ‘cost’ is not always a straightforward

concept. An accountant has a different view of ‘cost’ to that of an economist. The

M06 Operations Strategy 62492.indd 220 02/03/2017 13:05