Page 54 - Operations Strategy

P. 54

WHAT is THE ‘COnTEnT’ Of OPERATiOns sTRATEgy? 29

measures so that we can understand how it is built up. The best-known examples of this

occur in financial accounting. Here we will do it in a slightly different way by insert-

ing measures that have some meaning in an operations context. We are not proposing

this ratio analysis as a practical analysis tool. Rather, it is intended to provide some

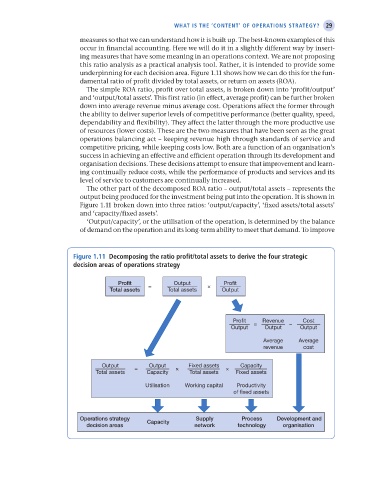

underpinning for each decision area. Figure 1.11 shows how we can do this for the fun-

damental ratio of profit divided by total assets, or return on assets (ROA).

The simple ROA ratio, profit over total assets, is broken down into ‘profit/output’

and ‘output/total assets’. This first ratio (in effect, average profit) can be further broken

down into average revenue minus average cost. Operations affect the former through

the ability to deliver superior levels of competitive performance (better quality, speed,

dependability and flexibility). They affect the latter through the more productive use

of resources (lower costs). These are the two measures that have been seen as the great

operations balancing act – keeping revenue high through standards of service and

competitive pricing, while keeping costs low. Both are a function of an organisation’s

success in achieving an effective and efficient operation through its development and

organisation decisions. These decisions attempt to ensure that improvement and learn-

ing continually reduce costs, while the performance of products and services and its

level of service to customers are continually increased.

The other part of the decomposed ROA ratio – output/total assets – represents the

output being produced for the investment being put into the operation. It is shown in

Figure 1.11 broken down into three ratios: ‘output/capacity’, ‘fixed assets/total assets’

and ‘capacity/fixed assets’.

‘Output/capacity’, or the utilisation of the operation, is determined by the balance

of demand on the operation and its long-term ability to meet that demand. To improve

Figure 1.11 Decomposing the ratio profit/total assets to derive the four strategic

decision areas of operations strategy

Profit = Output × Profit

Total assets Total assets Output

Profit Revenue Cost

Output = Output – Output

Average Average

revenue cost

Output Output Fixed assets Capacity

Total assets = Capacity × Total assets × Fixed assets

Utilisation Working capital Productivity

of fixed assets

Operations strategy Capacity Supply Process Development and

decision areas network technology organisation

M01 Operations Strategy 62492.indd 29 02/03/2017 13:00