Page 3 - ACI World Wide Salary Continuance Insurance

P. 3

Making Possibilities Happen | 03

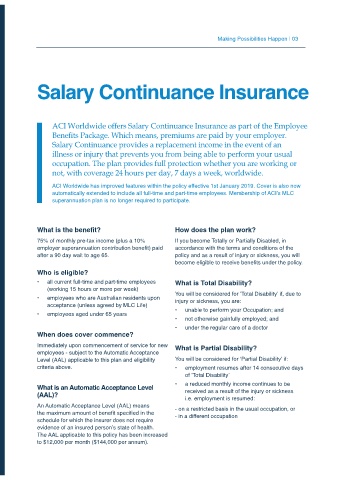

Salary Continuance Insurance

ACI Worldwide offers Salary Continuance Insurance as part of the Employee

Benefits Package. Which means, premiums are paid by your employer.

Salary Continuance provides a replacement income in the event of an

illness or injury that prevents you from being able to perform your usual

occupation. The plan provides full protection whether you are working or

not, with coverage 24 hours per day, 7 days a week, worldwide.

ACI Worldwide has improved features within the policy effective 1st January 2019. Cover is also now

automatically extended to include all full-time and part-time employees. Membership of ACI’s MLC

superannuation plan is no longer required to participate.

What is the benefit? How does the plan work?

75% of monthly pre-tax income (plus a 10% If you become Totally or Partially Disabled, in

employer superannuation contribution benefit) paid accordance with the terms and conditions of the

after a 90 day wait to age 65. policy and as a result of injury or sickness, you will

become eligible to receive benefits under the policy.

Who is eligible?

• all current full-time and part-time employees What is Total Disability?

(working 15 hours or more per week)

You will be considered for ‘Total Disability’ if, due to

• employees who are Australian residents upon

injury or sickness, you are:

acceptance (unless agreed by MLC Life)

• unable to perform your Occupation; and

• employees aged under 65 years

• not otherwise gainfully employed; and

• under the regular care of a doctor

When does cover commence?

Immediately upon commencement of service for new

What is Partial Disability?

employees - subject to the Automatic Acceptance

Level (AAL) applicable to this plan and eligibility You will be considered for ‘Partial Disability’ if:

criteria above. • employment resumes after 14 consecutive days

of ‘Total Disability’

• a reduced monthly income continues to be

What is an Automatic Acceptance Level

received as a result of the injury or sickness

(AAL)?

i.e. employment is resumed:

An Automatic Acceptance Level (AAL) means

- on a restricted basis in the usual occupation, or

the maximum amount of benefit specified in the

- in a different occupation

schedule for which the insurer does not require

evidence of an insured person’s state of health.

The AAL applicable to this policy has been increased

to $12,000 per month ($144,000 per annum).