Page 11 - Client Review Report Redacted

P. 11

Outlook

Our outlook isn’t overly changed but remains somewhat different from consensus (i.e. the broader

market), which presents both risk and opportunity. We continue to think the market is

underestimating the likely characteristics of a “soft-landing”, where we expect weaker economic

conditions ahead but aren’t necessarily in the recession camp. We also think the equity market is

too narrowly focused on a small number of winners, increasingly only benefiting anything A.I. related

whilst treating this thematic as somewhat immune from the economic backdrop. History shows that

nothing is immune to the economic backdrop, unless we’re now playing with monopoly money.

This goes somewhat to explaining our more cautious tone and stance in portfolios. We still want to

be participating in markets, but we’re very conscious of the risks surrounding inflated expectations

and overcrowded trades. A broadening of market winners would be a welcome reprieve, a boon for

truly active managers, given our preference for fundamentally focused/grounded long-term

investment approaches.

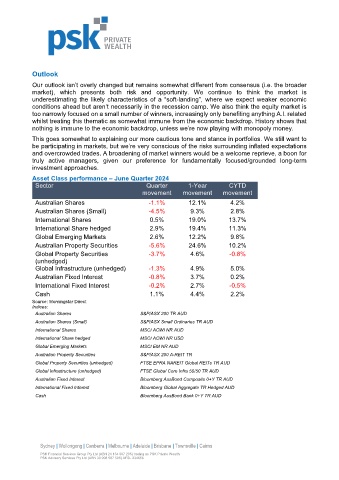

Asset Class performance – June Quarter 2024

Sector Quarter 1-Year CYTD

movement movement movement

Australian Shares -1.1% 12.1% 4.2%

Australian Shares (Small) -4.5% 9.3% 2.8%

International Shares 0.5% 19.0% 13.7%

International Share hedged 2.9% 19.4% 11.3%

Global Emerging Markets 2.6% 12.2% 9.8%

Australian Property Securities -5.6% 24.6% 10.2%

Global Property Securities -3.7% 4.6% -0.8%

(unhedged)

Global Infrastructure (unhedged) -1.3% 4.9% 5.0%

Australian Fixed Interest -0.8% 3.7% 0.2%

International Fixed Interest -0.2% 2.7% -0.5%

Cash 1.1% 4.4% 2.2%

Source: Morningstar Direct

Indices:

Australian Shares S&P/ASX 200 TR AUD

Australian Shares (Small) S&P/ASX Small Ordinaries TR AUD

International Shares MSCI ACWI NR AUD

International Share hedged MSCI ACWI NR USD

Global Emerging Markets MSCI EM NR AUD

Australian Property Securities S&P/ASX 200 A-REIT TR

Global Property Securities (unhedged) FTSE EPRA NAREIT Global REITs TR AUD

Global Infrastructure (unhedged) FTSE Global Core Infra 50/50 TR AUD

Australian Fixed Interest Bloomberg AusBond Composite 0+Y TR AUD

International Fixed Interest Bloomberg Global Aggregate TR Hedged AUD

Cash Bloomberg AusBond Bank 0+Y TR AUD

Sydney | Wollongong | Canberra | Melbourne | Adelaide | Brisbane | Townsville | Cairns

PSK Financial Services Group Pty Ltd (ABN 24 134 987 205) trading as PSK Private Wealth

PSK Advisory Services Pty Ltd (ABN 30 008 587 595) AFSL 234656