Page 8 - Client Review Report Redacted

P. 8

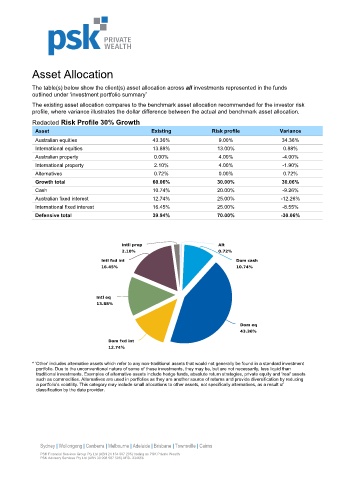

Asset Allocation

The table(s) below show the client(s) asset allocation across all investments represented in the funds

outlined under ‘investment portfolio summary’

The existing asset allocation compares to the benchmark asset allocation recommended for the investor risk

profile, where variance illustrates the dollar difference between the actual and benchmark asset allocation.

Redacted Risk Profile 30% Growth

Asset Existing Risk profile Variance

Australian equities 43.36% 9.00% 34.36%

International equities 13.88% 13.00% 0.88%

Australian property 0.00% 4.00% -4.00%

International property 2.10% 4.00% -1.90%

Alternatives 0.72% 0.00% 0.72%

Growth total 60.06% 30.00% 30.06%

Cash 10.74% 20.00% -9.26%

Australian fixed interest 12.74% 25.00% -12.26%

International fixed interest 16.45% 25.00% -8.55%

Defensive total 39.94% 70.00% -30.06%

* 'Other' includes alternative assets which refer to any non-traditional assets that would not generally be found in a standard investment

portfolio. Due to the unconventional nature of some of these investments, they may be, but are not necessarily, less liquid than

traditional investments. Examples of alternative assets include hedge funds, absolute return strategies, private equity and 'real' assets

such as commodities. Alternatives are used in portfolios as they are another source of returns and provide diversification by reducing

a portfolio’s volatility. This category may include small allocations to other assets, not specifically alternatives, as a result of

classification by the data provider.

Sydney | Wollongong | Canberra | Melbourne | Adelaide | Brisbane | Townsville | Cairns

PSK Financial Services Group Pty Ltd (ABN 24 134 987 205) trading as PSK Private Wealth

PSK Advisory Services Pty Ltd (ABN 30 008 587 595) AFSL 234656