Page 16 - Sapre - Review Report - July 2020

P. 16

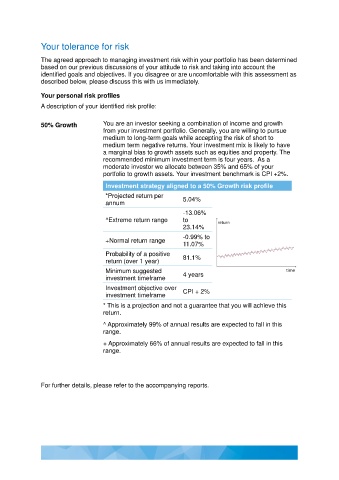

Your tolerance for risk

The agreed approach to managing investment risk within your portfolio has been determined

based on our previous discussions of your attitude to risk and taking into account the

identified goals and objectives. If you disagree or are uncomfortable with this assessment as

described below, please discuss this with us immediately.

Your personal risk profiles

A description of your identified risk profile:

50% Growth You are an investor seeking a combination of income and growth

from your investment portfolio. Generally, you are willing to pursue

medium to long-term goals while accepting the risk of short to

medium term negative returns. Your investment mix is likely to have

a marginal bias to growth assets such as equities and property. The

recommended minimum investment term is four years. As a

moderate investor we allocate between 35% and 65% of your

portfolio to growth assets. Your investment benchmark is CPI +2%.

Investment strategy aligned to a 50% Growth risk profile

*Projected return per

annum 5.04%

-13.06%

^Extreme return range to

23.14%

-0.99% to

+Normal return range

11.07%

Probability of a positive

return (over 1 year) 81.1%

Minimum suggested

investment timeframe 4 years

Investment objective over

investment timeframe CPI + 2%

* This is a projection and not a guarantee that you will achieve this

return.

^ Approximately 99% of annual results are expected to fall in this

range.

+ Approximately 66% of annual results are expected to fall in this

range.

For further details, please refer to the accompanying reports.