Page 23 - Sapre - Review Report - July 2020

P. 23

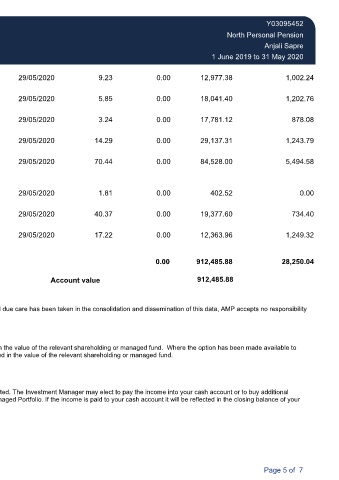

Y03095452

Y03095452

Review report - Mrs Anjali Sapre North Personal Pension

Review report - Mrs Anjali Sapre

North Personal Pension

Anjali Sapre

Anjali Sapre

1 June 2019 to 31 May 2020

1 June 2019 to 31 May 2020

19,901.31

0.00

1,406.00

29/05/2020

12,977.38

9.23

0.00

1,002.24

Suncorp Group Limited Ordinary Fully

Suncorp Group Limited Ordinary Fully 19,901.31 1,406.00 0.00 29/05/2020 9.23 0.00 12,977.38 1,002.24

Paid

Paid

15,357.94

0.00

3,084.00

0.00

1,202.76

18,041.40

5.85

29/05/2020

Sydney Airport Fully Paid Ordinary/ 15,357.94 3,084.00 0.00 29/05/2020 5.85 0.00 18,041.40 1,202.76

Sydney Airport Fully Paid Ordinary/

Units Stapled Securities

Units Stapled Securities

0.00

5,488.00

27,169.08

0.00

17,781.12

3.24

29/05/2020

878.08

Telstra Corporation Limited. Ordinary 27,169.08 5,488.00 0.00 29/05/2020 3.24 0.00 17,781.12 878.08

Telstra Corporation Limited. Ordinary

Fully Paid

Fully Paid

16,777.04

0.00

2,039.00

29/05/2020

14.29

29,137.31

1,243.79

0.00

Transurban Group Fully Paid Ordinary/

Transurban Group Fully Paid Ordinary/ 16,777.04 2,039.00 0.00 29/05/2020 14.29 0.00 29,137.31 1,243.79

Units Stapled Securities

Units Stapled Securities

0.00

80,150.52

1,200.00

84,528.00

29/05/2020

70.44

0.00

5,494.58

Vanguard Australian Property

Vanguard Australian Property 80,150.52 1,200.00 0.00 29/05/2020 70.44 0.00 84,528.00 5,494.58

Securities Index Etf Exchange Traded

Securities Index Etf Exchange Traded

Fund

Fund

223.00

0.00

894.23

402.52

0.00

0.00

1.81

29/05/2020

Virgin Money UK PLC Cdi 1:1 Foreign 894.23 223.00 0.00 29/05/2020 1.81 0.00 402.52 0.00

Virgin Money UK PLC Cdi 1:1 Foreign

Exempt Lse

Exempt Lse

0.00

480.00

14,560.60

29/05/2020

40.37

734.40

19,377.60

0.00

Wesfarmers Limited Ordinary Fully

Wesfarmers Limited Ordinary Fully 14,560.60 480.00 0.00 29/05/2020 40.37 0.00 19,377.60 734.40

Paid

Paid

23,785.08

0.00

718.00

0.00

12,363.96

29/05/2020

1,249.32

17.22

Westpac Banking Corporation Ordinary 23,785.08 718.00 0.00 29/05/2020 17.22 0.00 12,363.96 1,249.32

Westpac Banking Corporation Ordinary

Fully Paid

Fully Paid

912,485.88

0.00 912,485.88 28,250.04

28,250.04

0.00

912,485.88

Account value

Account value 912,485.88

Unit PricingUnit PricingUnit PricingUnit PricingUnit PricingUnit PricingUnit Pricing

Unit Pricing

The unit prices shown above are calculated as at the end of the reporting period by third party providers. While all due care has been taken in the consolidation and dissemination of this data, AMP accepts no responsibilityd of the reporting period by third party providers. While all due care has been taken in the consolidation and d

The unit prices shown above are calculated as at the en

and no warranty is provided for any errors or omissions..

and no warranty is provided for any errors or omissions

Income generated from your holdings (excluding managed

Income generated from your holdings (excluding managed portfolios)Income generated from your holdings (excluding managed portfolios)Income generated from your holdings (excluding managed portfolios)Income generated from your holdings (excluding managed portfolios)portfolios)Income generated from your holdings (excluding managed portf

Income generated from your investments may be paid into

Income generated from your investments may be paid into your cash account and therefore will not be reflected in the value of the relevant shareholding or managed fund. Where the option has been made available to your cash account and therefore will not be reflected in the value of the relevant shareholding or managed fund. Where t

you, and you have elected to reinvest the income (either distributions or dividends), these amounts will be reflected in the value of the relevant shareholding or managed fund.r distributions or dividends), these amounts will be reflected in the value of the relevant shareholding or managed fund.

you, and you have elected to reinvest the income (eithe

Income generated from your holdings in managed portfoliosIncome generated from your holdings in managed portfoliosIncome generated from your holdings in managed portfoliosIncome generated from your holdings in managed portfoliososIncome generated from your holdings in managed portfoliosIncome generated from your holdings in managed p

Income generated from your holdings in managed portfoli

Income generated by a Managed Portfolio is managed by t

Income generated by a Managed Portfolio is managed by the Investment Manager of the portfolio you have selected. The Investment Manager may elect to pay the income into your cash account or to buy additionalhe Investment Manager of the portfolio you have selected. The Investment Manager may elect to pay the income into your cash acco

shareholding or managed fund units. If the income is reinvested it will be reflected in the value of the relevant Managed Portfolio. If the income is paid to your cash account it will be reflected in the closing balance of yourinvested it will be reflected in the value of the relevant Managed Portfolio. If the income is paid to your

shareholding or managed fund units. If the income is re

account overall.

account overall.

All values and units displayed have been rounded to two decimal places. decimal places.

All values and units displayed have been rounded to two

Purchase cost has been proportionally allocated across

Purchase cost has been proportionally allocated across all holdings in the account.all holdings in the account.

Page 5 of 7

Date prepared: 24/06/2020 Page 5 of 7

Date prepared: 24/06/2020