Page 3 - AS Harrison & Co Salary Continuance Insurance

P. 3

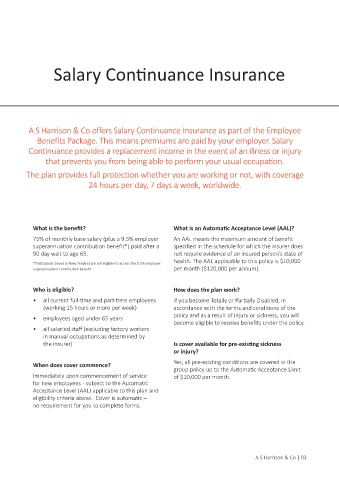

Salary Continuance Insurance

A S Harrison & Co offers Salary Continuance Insurance as part of the Employee

Benefits Package. This means premiums are paid by your employer. Salary

Continuance provides a replacement income in the event of an illness or injury

that prevents you from being able to perform your usual occupation.

The plan provides full protection whether you are working or not, with coverage

24 hours per day, 7 days a week, worldwide.

What is the benefit? What is an Automatic Acceptance Level (AAL)?

75% of monthly base salary (plus a 9.5% employer An AAL means the maximum amount of benefit

superannuation contribution benefit*) paid after a specified in the schedule for which the insurer does

90 day wait to age 65. not require evidence of an insured person’s state of

health. The AAL applicable to this policy is $10,000

*Participants based in New Zealand are not eligible to access the 9.5% employer

superannuation contribution benefit per month ($120,000 per annum).

Who is eligible? How does the plan work?

• all current full-time and part-time employees If you become Totally or Partially Disabled, in

(working 15 hours or more per week) accordance with the terms and conditions of the

• employees aged under 65 years policy and as a result of injury or sickness, you will

become eligible to receive benefits under the policy.

• all salaried staff (excluding factory workers

in manual occupations as determined by

the insurer) Is cover available for pre-existing sickness

or injury?

When does cover commence? Yes, all pre-existing conditions are covered in the

group policy up to the Automatic Acceptance Limit

Immediately upon commencement of service of $10,000 per month.

for new employees - subject to the Automatic

Acceptance Level (AAL) applicable to this plan and

eligibility criteria above. Cover is automatic –

no requirement for you to complete forms.

A S Harrison & Co | 03