Page 9 - Axicom Superannuation Information Booklet

P. 9

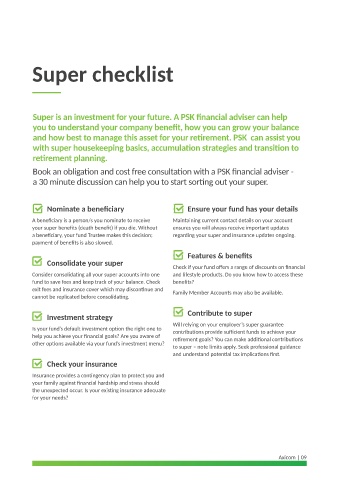

Super checklist

Super is an investment for your future. A PSK financial adviser can help

you to understand your company benefit, how you can grow your balance

and how best to manage this asset for your retirement. PSK can assist you

with super housekeeping basics, accumulation strategies and transition to

retirement planning.

Book an obligation and cost free consultation with a PSK financial adviser -

a 30 minute discussion can help you to start sorting out your super.

Nominate a beneficiary Ensure your fund has your details

A beneficiary is a person/s you nominate to receive Maintaining current contact details on your account

your super benefits (death benefit) if you die. Without ensures you will always receive important updates

a beneficiary, your fund Trustee makes this decision; regarding your super and insurance updates ongoing.

payment of benefits is also slowed.

Features & benefits

Consolidate your super

Check if your fund offers a range of discounts on financial

Consider consolidating all your super accounts into one and lifestyle products. Do you know how to access these

fund to save fees and keep track of your balance. Check benefits?

exit fees and insurance cover which may discontinue and Family Member Accounts may also be available.

cannot be replicated before consolidating.

Investment strategy Contribute to super

Will relying on your employer’s super guarantee

Is your fund’s default investment option the right one to contributions provide sufficient funds to achieve your

help you achieve your financial goals? Are you aware of retirement goals? You can make additional contributions

other options available via your fund’s investment menu? to super – note limits apply. Seek professional guidance

and understand potential tax implications first.

Check your insurance

Insurance provides a contingency plan to protect you and

your family against financial hardship and stress should

the unexpected occur. Is your existing insurance adequate

for your needs?

Axicom | 09