Page 79 - Report Final MMIX 31 Des 2022

P. 79

These financial statements are originally issued in Indonesian language.

- 68 -

PT MULTI MEDIKA INTERNASIONAL Tbk PT MULTI MEDIKA INTERNASIONAL Tbk

CATATAN ATAS LAPORAN KEUANGAN (Lanjutan) NOTES TO THE FINANCIAL STATEMENTS (Continued)

UNTUK 31 DESEMBER 2022 DAN 2021 DECEMBER 31, 2022 AND 2021

(Disajikan dalam Rupiah, kecuali dinyatakan lain) (Expressed in Rupiah, unless otherwise stated)

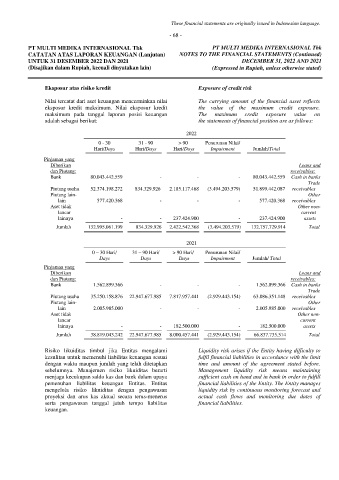

Eksposur atas risiko kredit Exposure of credit risk

Nilai tercatat dari aset keuangan mencerminkan nilai The carrying amount of the financial asset reflects

eksposur kredit maksimum. Nilai eksposur kredit the value of the maximum credit exposure.

maksimum pada tanggal laporan posisi keuangan The maximum credit exposure value on

adalah sebagai berikut: the statements of financial position are as follows:

2022

0 - 30 31 - 90 > 90 Penurunan Nilai/

Hari/Days Hari/Days Hari/Days Impairment Jumlah/Total

Pinjaman yang

Diberikan Loans and

dan Piutang: receivables:

Bank 80.043.442.559 - - - 80.043.442.559 Cash in banks

Trade

Piutang usaha 52.374.198.272 834.329.926 2.185.117.468 (3.494.203.579) 51.899.442.087 receivables

Piutang lain- Other

lain 577.420.368 - - - 577.420.368 receivables

Aset tidak Other non-

lancar current

lainnya - - 237.424.900 - 237.424.900 assets

Jumlah 132.995.061.199 834.329.926 2.422.542.368 (3.494.203.579) 132.757.729.914 Total

2021

0 – 30 Hari/ 31 – 90 Hari/ > 90 Hari/ Penurunan Nilai/

Days Days Days Impairment Jumlah/ Total

Pinjaman yang

Diberikan Loans and

dan Piutang: receivables:

Bank 1.562.899.366 - - - 1.562.899.366 Cash in banks

Trade

Piutang usaha 35.250.158.876 22.947.677.985 7.817.957.441 (2.929.443.154) 63.086.351.148 receivables

Piutang lain- Other

lain 2.005.985.000 - - - 2.005.985.000 receivables

Aset tidak Other non-

lancar current

lainnya - - 182.500.000 - 182.500.000 assets

Jumlah 38.819.043.242 22.947.677.985 8.000.457.441 (2.929.443.154) 66.837.735.514 Total

Risiko likuiditas timbul jika Entitas mengalami Liquidity risk arises if the Entity having difficulty to

kesulitan untuk memenuhi liabilitas keuangan sesuai fulfil financial liabilities in accordance with the limit

dengan waktu maupun jumlah yang telah ditetapkan time and amount of the agreement stated before.

sebelumnya. Manajemen risiko likuiditas berarti Management liquidity risk means maintaining

menjaga kecukupan saldo kas dan bank dalam upaya sufficient cash on hand and in bank in order to fulfill

pemenuhan liabilitas keuangan Entitas. Entitas financial liabilities of the Entity. The Entity manages

mengelola risiko likuiditas dengan pengawasan liquidity risk by continuous monitoring forecast and

proyeksi dan arus kas aktual secara terus-menerus actual cash flows and monitoring due dates of

serta pengawasan tanggal jatuh tempo liabilitas financial liabilities.

keuangan.