Page 8 - Cover Letter and Cost Estimates for Ms. LaVerne Durham

P. 8

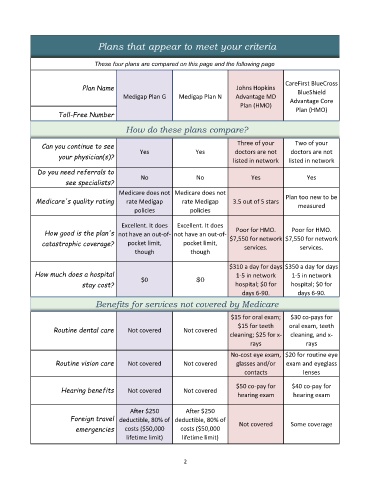

Plans that appear to meet your criteria

These four plans are compared on this page and the following page

CareFirst BlueCross

Plan Name Johns Hopkins BlueShield

Medigap Plan G Medigap Plan N Advantage MD Advantage Core

Plan (HMO) Plan (HMO)

Toll-Free Number

QuaSection Heading How do these plans compare?

lity ratings from

Can you continue to see Three of your Two of your

your physician(s)? Yes Yes doctors are not doctors are not

listed in network listed in network

Do you need referrals to

see specialists? No No Yes Yes

Medicare does not Medicare does not

Medicare's quality rating rate Medigap rate Medigap 3.5 out of 5 stars Plan too new to be

measured

policies policies

Excellent. It does Excellent. It does

How good is the plan's not have an out-of- not have an out-of- Poor for HMO. Poor for HMO.

catastrophic coverage? pocket limit, pocket limit, $7,550 for network $7,550 for network

services.

services.

though though

$310 a day for days $350 a day for days

How much does a hospital 1-5 in network 1-5 in network

stay cost? $0 $0 hospital; $0 for hospital; $0 for

days 6-90. days 6-90.

Benefits for services not covered by Medicare

$15 for oral exam; $30 co-pays for

$15 for teeth oral exam, teeth

Routine dental care Not covered Not covered

cleaning; $25 for x- cleaning, and x-

rays rays

No-cost eye exam, $20 for routine eye

Routine vision care Not covered Not covered glasses and/or exam and eyeglass

contacts lenses

$50 co-pay for $40 co-pay for

Hearing benefits Not covered Not covered

hearing exam hearing exam

After $250 After $250

Foreign travel deductible, 80% of deductible, 80% of Not covered Some coverage

emergencies costs ($50,000 costs ($50,000

lifetime limit) lifetime limit)

2