Page 131 - Commercial - Underwriting Mandates & Guidelines Binder

P. 131

Motor Traders

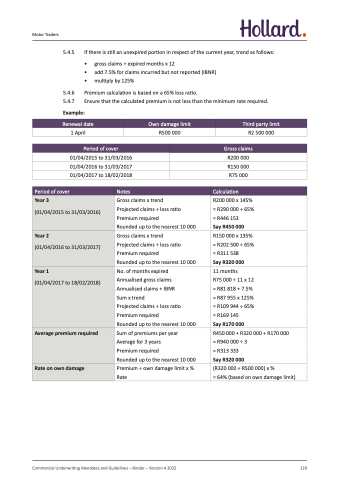

5.4.5 If there is still an unexpired portion in respect of the current year, trend as follows:

• gross claims ÷ expired months x 12

• add 7.5% for claims incurred but not reported (IBNR)

• multiply by 125%

5.4.6 Premium calculation is based on a 65% loss ratio.

5.4.7 Ensure that the calculated premium is not less than the minimum rate required.

Example:

1 April

R500 000

R2 500 000

R200 000 R150 000 R75 000

R200 000 x 145% = R290 000 ÷ 65% = R446 153

Say R450 000 R150 000 x 135% = R202 500 ÷ 65% = R311 538

Say R320 000

11 months

R75 000 ÷ 11 x 12

= R81 818 + 7.5%

= R87 955 x 125%

= R109 944 ÷ 65%

= R169 145

Say R170 000

R450 000 + R320 000 + R170 000

= R940 000 ÷ 3

= R313 333

Say R320 000

(R320 000 ÷ R500 000) x %

= 64% (based on own damage limit)

Renewal date

Own damage limit

Third party limit

Period of cover

Period of cover

Notes

Calculation

Year 3

(01/04/2015 to 31/03/2016)

Gross claims x trend

Projected claims ÷ loss ratio

Premium required

Rounded up to the nearest 10 000

Year 2

(01/04/2016 to 31/03/2017)

Gross claims x trend

Projected claims ÷ loss ratio

Premium required

Rounded up to the nearest 10 000

Year 1

(01/04/2017 to 18/02/2018)

No. of months expired

Annualised gross claims

Annualised claims + IBNR

Sum x trend

Projected claims ÷ loss ratio

Premium required

Rounded up to the nearest 10 000

Average premium required

Sum of premiums per year

Average for 3 years

Premium required

Rounded up to the nearest 10 000

Rate on own damage

Premium ÷ own damage limit x %

Rate

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022

129

Gross claims

01/04/2015 to 31/03/2016

01/04/2016 to 31/03/2017

01/04/2017 to 18/02/2018