Page 133 - Commercial - Underwriting Mandates & Guidelines Binder

P. 133

Motor Traders

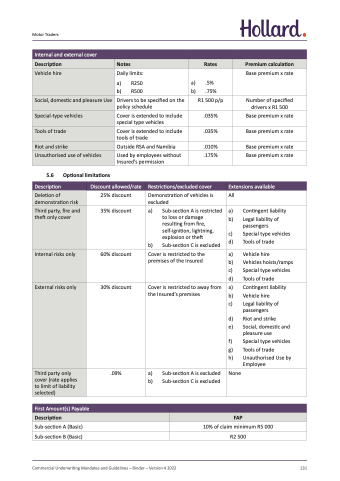

Internal and external cover

Description

Notes

Rates

Premium calculation

Vehicle hire

Daily limits:

a) R250

b) R500

a) .5%

b) .75%

Base premium x rate

Social, domestic and pleasure Use

Special-type vehicles

Tools of trade

Riot and strike

Unauthorised use of vehicles

Drivers to be specified on the policy schedule

Cover is extended to include special type vehicles

Cover is extended to include tools of trade

Outside RSA and Namibia

Used by employees without Insured’s permission

R1 500 p/p

.035%

.035%

.010%

.175%

Number of specified drivers x R1 500

Base premium x rate

Base premium x rate

Base premium x rate

Base premium x rate

All

5.6 Optional limitations

Description

Deletion of demonstration risk

Discount allowed/rate

Restrictions/excluded cover

Extensions available

Third party, fire and theft only cover

35% discount

a) Sub-section A is restricted to loss or damage

resulting from fire, self-ignition, lightning, explosion or theft

b) Sub-section C is excluded

a) Contingent liability

b) Legal liability of passengers

c) Special type vehicles

d) Tools of trade

Internal risks only

60% discount

Cover is restricted to the premises of the Insured

a) Vehicle hire

b) Vehicles hoists/ramps

c) Special type vehicles

d) Tools of trade

External risks only

30% discount

Cover is restricted to away from the Insured’s premises

a) Contingent liability

b) Vehicle hire

c) Legal liability of passengers

d) Riot and strike

e) Social, domestic and pleasure use

f) Special type vehicles

g) Tools of trade

h) Unauthorised Use by Employee

Third party only cover (rate applies to limit of liability selected)

.09%

a) Sub-section A is excluded

b) Sub-section C is excluded

None

Sub-section A (Basic) Sub-section B (Basic)

10% of claim minimum R5 000 R2 500

25% discount

Demonstration of vehicles is excluded

First Amount(s) Payable

Description

FAP

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022

131