Page 132 - Commercial - Underwriting Mandates & Guidelines Binder

P. 132

5.5

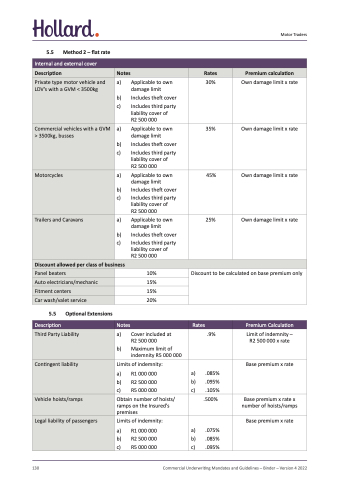

Method 2 – flat rate

10% 15% 15% 20%

Discount to be calculated on base premium only

Motor Traders

Internal and external cover

Description

Notes

Rates

Premium calculation

Private type motor vehicle and LDV’s with a GVM < 3500kg

a) Applicable to own damage limit

b) Includes theft cover

c) Includes third party liability cover of

R2 500 000

30%

Own damage limit x rate

Commercial vehicles with a GVM > 3500kg, busses

a) Applicable to own damage limit

b) Includes theft cover

c) Includes third party liability cover of

R2 500 000

35%

Own damage limit x rate

Motorcycles

a) Applicable to own damage limit

b) Includes theft cover

c) Includes third party liability cover of

R2 500 000

45%

Own damage limit x rate

Trailers and Caravans

a) Applicable to own damage limit

b) Includes theft cover

c) Includes third party liability cover of

R2 500 000

25%

Own damage limit x rate

Discount allowed per class of business

Panel beaters

Auto electricians/mechanic

Fitment centers

Car wash/valet service

5.5 Optional Extensions

Description

Third Party Liability

Notes

Rates

Premium Calculation

a) Cover included at R2 500 000

b) Maximum limit of indemnity R5 000 000

.9%

Limit of indemnity – R2 500 000 x rate

Contingent liability

Limits of indemnity:

a) R1 000 000

b) R2 500 000

c) R5 000 000

a) .085%

b) .095%

c) .105%

Base premium x rate

Vehicle hoists/ramps

Legal liability of passengers

Limits of indemnity:

a) R1 000 000

b) R2 500 000

c) R5 000 000

a) .075%

b) .085%

c) .095%

Base premium x rate

Obtain number of hoists/ ramps on the Insured’s premises

.500%

Base premium x rate x number of hoists/ramps

130

Commercial Underwriting Mandates and Guidelines – Binder – Version 4 2022