Page 8 - HC Public Policy Guide

P. 8

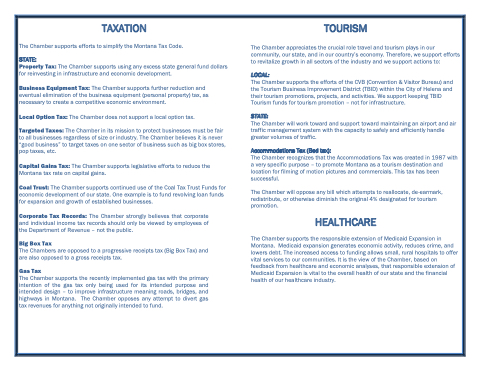

TAXATION

The Chamber supports efforts to simplify the Montana Tax Code.

STATE:

Property Tax: The Chamber supports using any excess state general fund dollars for reinvesting in infrastructure and economic development.

Business Equipment Tax: The Chamber supports further reduction and eventual elimination of the business equipment (personal property) tax, as necessary to create a competitive economic environment.

Local Option Tax: The Chamber does not support a local option tax.

Targeted Taxes: The Chamber in its mission to protect businesses must be fair to all businesses regardless of size or industry. The Chamber believes it is never “good business” to target taxes on one sector of business such as big box stores, pop taxes, etc.

Capital Gains Tax: The Chamber supports legislative efforts to reduce the Montana tax rate on capital gains.

Coal Trust: The Chamber supports continued use of the Coal Tax Trust Funds for economic development of our state. One example is to fund revolving loan funds for expansion and growth of established businesses.

Corporate Tax Records: The Chamber strongly believes that corporate and individual income tax records should only be viewed by employees of the Department of Revenue – not the public.

Big Box Tax

The Chambers are opposed to a progressive receipts tax (Big Box Tax) and are also opposed to a gross receipts tax.

Gas Tax

The Chamber supports the recently implemented gas tax with the primary intention of the gas tax only being used for its intended purpose and intended design – to improve infrastructure meaning roads, bridges, and highways in Montana. The Chamber opposes any attempt to divert gas tax revenues for anything not originally intended to fund.

TOURISM

The Chamber appreciates the crucial role travel and tourism plays in our community, our state, and in our country’s economy. Therefore, we support efforts to revitalize growth in all sectors of the industry and we support actions to:

LOCAL:

The Chamber supports the efforts of the CVB (Convention & Visitor Bureau) and the Tourism Business Improvement District (TBID) within the City of Helena and their tourism promotions, projects, and activities. We support keeping TBID Tourism funds for tourism promotion – not for infrastructure.

STATE:

The Chamber will work toward and support toward maintaining an airport and air traffic management system with the capacity to safely and efficiently handle greater volumes of traffic.

Accommodations Tax (Bed tax):

The Chamber recognizes that the Accommodations Tax was created in 1987 with a very specific purpose – to promote Montana as a tourism destination and location for filming of motion pictures and commercials. This tax has been successful.

The Chamber will oppose any bill which attempts to reallocate, de-earmark, redistribute, or otherwise diminish the original 4% designated for tourism promotion.

HEALTHCARE

The Chamber supports the responsible extension of Medicaid Expansion in Montana. Medicaid expansion generates economic activity, reduces crime, and lowers debt. The increased access to funding allows small, rural hospitals to offer vital services to our communities. It is the view of the Chamber, based on feedback from healthcare and economic analyses, that responsible extension of Medicaid Expansion is vital to the overall health of our state and the financial health of our healthcare industry.