Page 139 - 2019-20 CAFR

P. 139

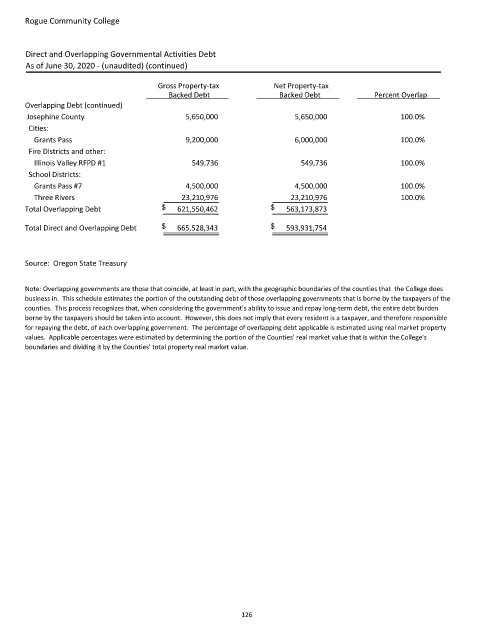

Rogue Community College

Direct and Overlapping Governmental Activities Debt

As of June 30, 2020 (unaudited) (continued)

Gross Propertytax Net Propertytax

Backed Debt Backed Debt Percent Overlap

Overlapping Debt (continued)

Josephine County 5,650,000 5,650,000 100.0%

Cities:

Grants Pass 9,200,000 6,000,000 100.0%

Fire Districts and other:

Illinois Valley RFPD #1 549,736 549,736 100.0%

School Districts:

Grants Pass #7 4,500,000 4,500,000 100.0%

Three Rivers 23,210,976 23,210,976 100.0%

Total Overlapping Debt $ 621,550,462 $ 563,173,873

Total Direct and Overlapping Debt $ 665,528,343 $ 593,931,754

Source: Oregon State Treasury

Note: Overlapping governments are those that coincide, at least in part, with the geographic boundaries of the counties that the College does

business in. This schedule estimates the portion of the outstanding debt of those overlapping governments that is borne by the taxpayers of the

counties. This process recognizes that, when considering the government's ability to issue and repay longterm debt, the entire debt burden

borne by the taxpayers should be taken into account. However, this does not imply that every resident is a taxpayer, and therefore responsible

for repaying the debt, of each overlapping government. The percentage of overlapping debt applicable is estimated using real market property

values. Applicable percentages were estimated by determining the portion of the Counties' real market value that is within the College's

boundaries and dividing it by the Counties' total property real market value.

126