Page 134 - 2019-20 CAFR

P. 134

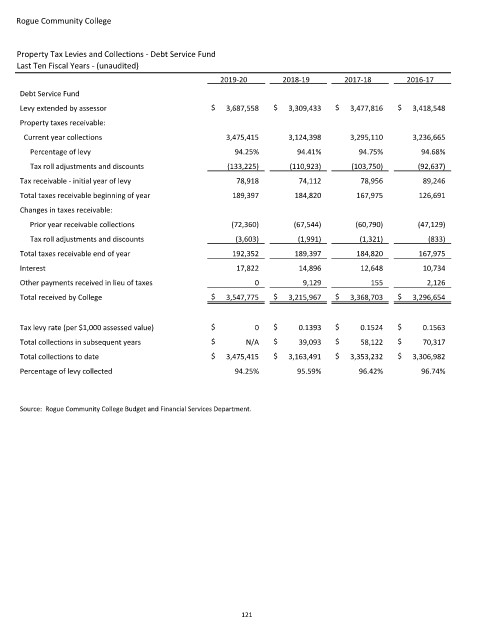

Rogue Community College

Property Tax Levies and Collections ‐ Debt Service Fund

Last Ten Fiscal Years ‐ (unaudited)

2019‐20 2018‐19 2017‐18 2016‐17

Debt Service Fund

Levy extended by assessor $ 3,687,558 $ 3,309,433 $ 3,477,816 $ 3,418,548

Property taxes receivable:

Current year collections 3,475,415 3,124,398 3,295,110 3,236,665

Percentage of levy 94.25% 94.41% 94.75% 94.68%

Tax roll adjustments and discounts (133,225) (110,923) (103,750) (92,637)

Tax receivable ‐ initial year of levy 78,918 74,112 78,956 89,246

Total taxes receivable beginning of year 189,397 184,820 167,975 126,691

Changes in taxes receivable:

Prior year receivable collections (72,360) (67,544) (60,790) (47,129)

Tax roll adjustments and discounts (3,603) (1,991) (1,321) (833)

Total taxes receivable end of year 192,352 189,397 184,820 167,975

Interest 17,822 14,896 12,648 10,734

Other payments received in lieu of taxes 0 9,129 155 2,126

Total received by College $ 3,547,775 $ 3,215,967 $ 3,368,703 $ 3,296,654

Tax levy rate (per $1,000 assessed value) $ 0 $ 0.1393 $ 0.1524 $ 0.1563

Total collections in subsequent years $ N/A $ 39,093 $ 58,122 $ 70,317

Total collections to date $ 3,475,415 $ 3,163,491 $ 3,353,232 $ 3,306,982

Percentage of levy collected 94.25% 95.59% 96.42% 96.74%

Source: Rogue Community College Budget and Financial Services Department.

121